What Is a Public-Private Partnership?

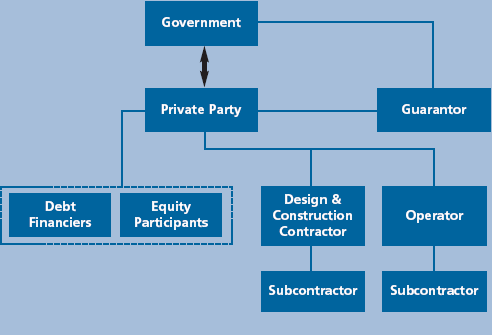

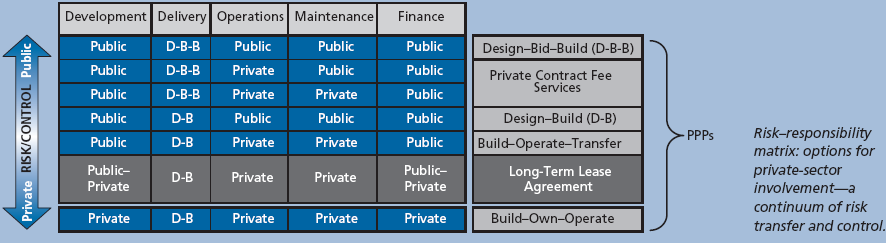

| Public-private partnerships (PPPs) comprise a variety of project financing and delivery methods that can expedite projects, relieve the public of certain risks, and leverage public funds. In the construction of infrastructure, PPP arrangements have evolved from design-build to design-build- finance-operate-maintain, with many options in between, representing a continuum between public and private funds, along with public and private responsibility (see figure, below). The United Kingdom has one of the longest-standing comprehensive national PPP programs, extending across all aspects of infrastructure. In 1992, Prime Minister John Major's government established the Private Financing Initiative (PFI), and more than 625 PFI transportation and other projects have been inked, with a total capital value approaching £60 billion. This is a centralized approach, with major transportation projects funded directly by the government; each ministry vets candidates for PPPs as part of the normal procurement process. Other successful models for PPPs can be found in Canada and Australia; in both nations, the arrangements were initiated at the state or provincial level, and national organizations built on that success. In 2008, Canada created PPP Canada as a government corporation to promote PPPs at the provincial level and committed $1.25 billion for up to 25 percent of the initial construction costs. A typical international concession |

structure is shown in the figure above. The international market of PPPs operates in a financial environment different from that of the United States. In Europe, governmental entities typically deal with banks for project financing, and the corporations that undertake the projects have both public and private owners. With the arrival of the long-term concession model in the United States, the primary participants have been international firms-few domestic firms have had the opportunity as yet to develop the expertise for these projects. - Pamela Bailey-Campbell |

|

| |

|

The Pocahontas Parkway near Richmond, Virginia, opened in 2002 and was leased to a private entity in 2006. | |

ment; we have failed to pursue the kind of innovation necessary to ensure that our infrastructure meets the demands of future generations. (J)

Although innovative finance and delivery cannot substitute for new funding, PPPs can offer an effective and productive solution.