The UK can learn from best practice in other countries

The PPP market has been developing swiftly in Europe. The number of contracts procured and the value of contracts signed has shot up in recent years. From 2001 to 2006 in Europe (excluding the UK) the largest deals signed were all infrastructure-related - bridges, tunnels, rail, roads, airports and canals.10 The most contracts being procured during this period was by the Italian government. The largest contracts in the EU over this period were a €1,300m contract signed by the Belgian government in 2004 for road infrastructure, and one of €1,200m by the Dutch government to deliver a railway. While other governments are learning from the UK experience, lessons can also be learnt in the opposite direction. The increase in the use of PPPs is mirrored across the globe, and countries are developing innovative models and techniques which the UK can also learn from.

With this in mind, a number of countries are leading the way in some PPP areas:

■ The speed of the procurement process in Spain has been noted by contractors

■ Australia is still leading the way on PPP toll roads

■ Canada is experimenting with non-asset based PFIs such as the Driver Examination Services

■ Japan is moving forward quickly in building on PFI and developing new models which have the potential to go beyond many UK initiatives.

In Japan, the Project Delivery Organisation (PDO) model is being used to deliver the Tana hospital in Tokyo. This model was also put forward in 2006 by the UK Treasury in the report PFI: strengthening long-term partnerships. The PDO model manages the delivery of a project through procurement, construction and operation. The PDO becomes the deliverer of the service to the public sector client on completion of the procurement phases. The aim of the model is to effectively manage procurement through early contractor involvement.

CASE STUDY | Serco in Canada |

In September 2003, Serco formed a PPP with the Ontario Ministry of Transportation (MTO) to deliver driver examination services. Before the PPP was established some motorists were required to wait up to 15 months between applying for and taking a road test. One of MTO's specific objectives for the private provide was to improve customer service levels and provide demonstrable value to the government - transparency in the process was an important element given the high-profile concerns about the effect of outsourcing on public safety. The use of technology to allow applicants to book tests online, the replacement of examiners' clipboards with handheld computers, allocating examiners to centres where demand is high and opening on Sunday mornings were some of the changes introduced to make the service more flexible and responsive to users, while also saving money. Service improvements include waiting times being reduced to an average of five weeks; calls to the call centre being reduced by 25% within the first three months; the refurbishment of offices; and the extension of opening hours in certain locations. | |

This can deliver:

■ Reduced procurement times, as the private sector partner is incentivised to deliver on time

■ Improved procurement capability

■ Early private sector involvement in projects.11

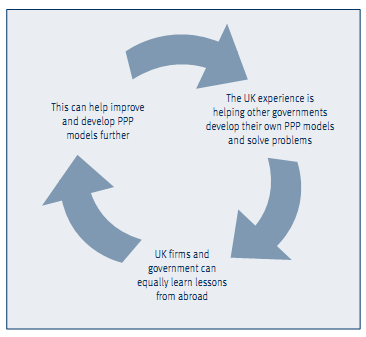

The diagram below (Exhibit 3) illustrates the 'virtuous circle of international PPP development'. The UK experience is helping other governments to develop their own PPP models and markets. In the same way, the UK is learning from other countries that are designing new models to move forward in PPPs - as seen in Japan. Building on the lessons learnt is a driver of success and can help improve PPP models further.

EXHIBIT 3 |

| The ‘virtuous circle’ of international PPP development |