Project budgeted cost variance

2.16 Approved budgeted cost variations are disaggregated by the DMO into three main factors: price (material and labour) indexation, exchange rate variation and real variation. The first two factors are generally standard provisions in acquisition projects that extend over a number of years, and essentially represent budgeted cost variations that are outside the direct control of project management.63

2.17 As previously explained, from 1 July 2010, all projects' approved budgets include the total price indexation, adjusted for the Specialist Military Equipment Weighted Average (SMEWA)64 or other appropriate index, to the point of the project's forecast FOC. This is defined as the budget being 'out turned'.65 In 2010-11, this indexation adjustment resulted in 23 of the 28 projects having received a one-off variation totalling $1.16 billion. Five projects which had been originally approved in out turned prices had their approved out turned budgets confirmed.66

2.18 Real variations in project budgeted costs primarily reflect changes in the scope of projects, transfers between projects for approved equipment/capability, and budgetary adjustments such as administrative savings decisions.

2.19 Of particular note in previous MPRs, and again for the 2010-11 report, is the impact of the exchange rate on projects' budgets. Exchange rate variations in project budgeted costs are a result of projects' exposure to foreign currencies and movement in foreign exchange rates. The Australian dollar was slightly stronger throughout the 2010-11 financial year, exceeding parity with the US dollar for a considerable period of time.

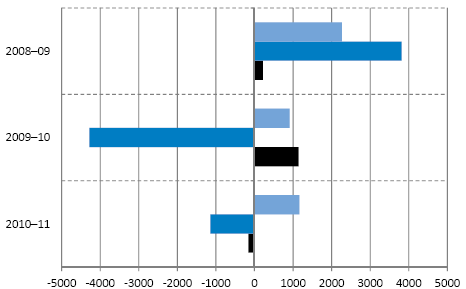

2.20 Figure 5 examines the three main factors contributing to budgeted cost variations in each of the last three years, and highlights the significant in-yea impact of variations for the 28 projects in the 2010-11 MPR.

Figure 5

In-year (2008-09, 2009-10 and 2010-11) budgeted cost changes ($m)

| ||

|

|

|

Source: 2010-11 MPR and Project Cost Approval Histories. | ||

2.21 In 2008-09, for the 28 projects covered by the 2010-11 MPR, total project budgeted costs increased by $3.8 billion due to foreign exchange movements. In 2009-10, a stronger Australian dollar led to a $4.3 billion decrease in project budgeted costs. In 2010-11, project budgeted costs have again decreased by $1.1 billion due to foreign exchange movements.

2.22 Overall, the 30 June 2011 approved budgeted cost of the 28 projects in the 2010-11 MPR decreased by $135.1 million or 0.3 per cent, compared to their 30 June 2010 approved budget. This was driven by a decrease in foreign exchange variations of $1.14 billion and real decreases of $0.16 billion and offset by a $1.16 billion increase due to price indexation.

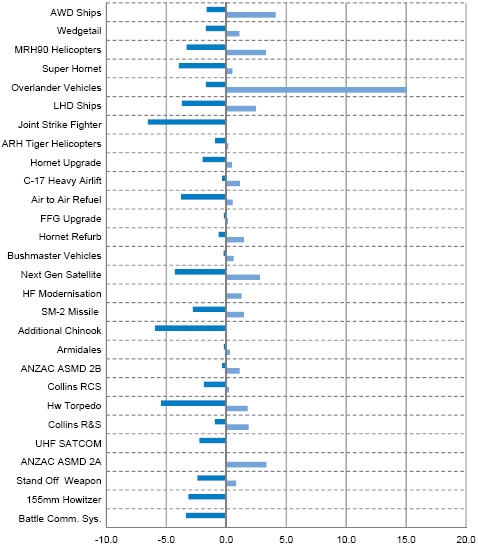

2.23 Figure 6 sets out the foreign exchange and price variation movement for each of the 28 projects' budgeted cost. Projects with significant movement in price variation, as a result of the out turning indexation adjustment, include:

• Overlander Vehicles ($433.6 million, or 15.1 per cent increase in budgeted cost);

• AWD Ships ($318.4 million, or 4.1 per cent increase in budgeted cost); and

• MRH90 Helicopters ($123.7 million, or 3.3 per cent increase in budgeted cost).

2.24 Projects with significant movement in foreign exchange, as a result of the stronger Australian dollar, include:

• Joint Strike Fighter ($186.8 million, or 6.5 per cent decrease in budgeted cost);

• Additional Chinook ($36.9 million, or 5.9 per cent decrease in budgeted cost); and

• Hw Torpedo ($24 million, or 5.4 per cent decrease in budgeted cost).

Figure 6

In-year (2010-11) budgeted cost changes (percentage variation by factor)

| |

|

|

Sources: 2010-11 MPR and Project Cost Approval Histories. | |

__________________________________________________________________________________

63 Australian Government arrangements for foreign exchange variation involve 'no win/no loss' supplementation. As a matter of policy, unless specifically approved, individual agencies are not permitted to 'hedge' against foreign exchange risk.

64 Australian National Audit Office, 2010-11 Major Projects Report, Part 2, paragraph 2.9, p. 148.

65 Australian National Audit Office, 2010-11 Major Projects Report, Part 2, paragraph 1.79, p. 136.

66 This resulted in UHF SATCOM receiving a negative adjustment. See Part 2, Table 2.5, p. 149.