A. The seven stages of the project implementation process

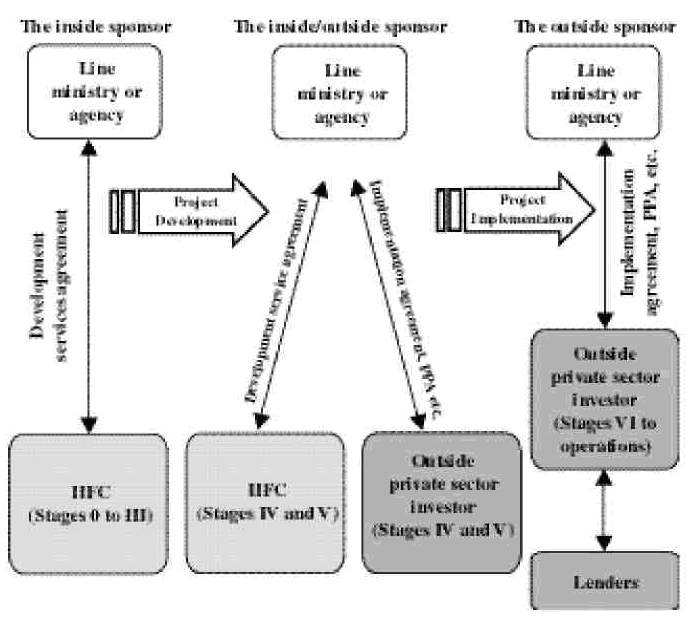

IIFC facilitates the implementation of solicited infrastructure projects by the private sector. It has conceptualized a seven-stage process for this purpose as illustrated in figure 1. The figure also lists the key activities at each of these seven stages. In this process, it is envisaged that IIFC, as the inside sponsor, would match the technical, financial, commercial, legal and negotiation skills of the private investors. The speed and flexibility of employing reliable consultants by IIFC to undertake project development activities should also be similar to that of the private sector.

In Stage 0, IIFC selects a potential infrastructure project after discussion with the concerned ministry or public agency. Social objectives of the Government and public service obligations that may need to be included should be considered at this stage. Project identification skills are extremely important for this stage. Otherwise, time and effort are wasted in the end. Government commitment to project development is important for IIFC. This is obtained by making a development services agreement (DSA) with the government agency (figure 2). The signing of a DSA may take between two months and one year, and in some cases longer than that.

In Stage I, project ideas are further developed and the feasibility study is undertaken. Major technical and transaction parameters are also identified and agreed upon at this stage. IIFC engages its own staff and consultants, who may be expatriate or local, to carry out these tasks. It mobilizes experienced consultants very quickly. Rapid deployment of consultants (within a target period of one month) is achieved through arrangements with consulting firms appointed through donor support as mentioned earlier. Funds available from IDA may also be used for engaging consultants. However, use of such funds is limited as recruitment of IDA-funded consultants may require a much longer time to meet their procedural requirements.

Stage II is the most critical phase in the process. It relates to preparing the commercial framework of the project, obtaining agreement of government for pre-qualification documents, inviting expressions of interest from the private sector and making a shortlist of prospective developers, and developing a model contractual framework. In situations where precedence for private investments does not exist and the approval process is unclear, government decisions at various levels could be slow and sometimes unfavourable to private investment. Lack of knowledge and experience compounds the problem. The model concession agreement prepared at this stage also provides for risk allocation between the private and public sectors.

In Stage III, project promotion takes place. Bids are invited from the short-listed bidders. With assistance from IIFC, bids are evaluated and the Government approves the successful bidder. This stage ends with the selection of the private project developer.

In Stage IV, IIFC assists the concerned government agency in negotiating the project with the selected project developer. Assistance is provided in the negotiation process in matters related to technical, commercial, financial and legal aspects of the project. This stage ends with the signing of the concession agreement between the government agency and the private sector project developer or outside sponsor (figure 2). Stages III and IV represent the handover phases from IIFC to the project developer. It is evident from figures 1 and 2 that IIFC as the inside sponsor invests its time, money and skills in project development from Stages 0 to IV, while the private investor takes up the responsibility from Stage IV onwards.

[Access Figure 1. Key stages in project development - PDF]

Note PPA power purchase agreement.

Figure 2. Changeover from inside sponsor to outside sponsor

In Stage V, the selected project developer seeks financing from different lenders and this stage ends with financial closure of the project.

In the final Stage VI, with equity and loan funds in place, the developer engages the construction contractor and physical construction starts. At the end of this stage, the facility goes into commercial operation.