1. CHOOSE A PPP FOR THE RIGHT REASONS

PPPs can be an effective way to provide infrastructure. However, they are not a free lunch, and have costs very similar to public investments. For example, when a state or local government sets up a PPP to build, maintain, and operate a highway in exchange for toll revenue, drivers are still on the hook for tolls and the government relinquishes future toll revenues. Similarly, if the government leases an existing highway in exchange for a lump sum payment, it is exchanging future flows of toll revenue for present funds.

PPPs have the greatest potential to achieve efficiency gains by bundling responsibility for the initial capital investment with future maintenance and operating costs. This ensures that a firm has the right incentives to appropriately minimize operating and maintenance costs at the time of the initial investment.

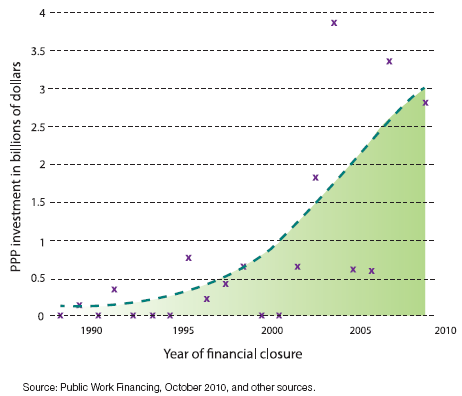

Figure 2

Public Private Partnership Investment in the

U.S. Transport Sector

Although billed as a way to screen against projects that create no social value-such as the infamous "bridge to nowhere"- PPPs do not always guard against wasteful spending. If the project is repaid by user fees, the presumption is that private firms will not participate unless the project is profitable, which provides a defense against bad projects. But in the case of projects financed by future taxation (as in the case of jails), there is no market test for the desirability of the project. For this reason, PPPs that require public funds should be subject to cost-benefit analysis to determine if the project is a good use of scarce resources. Needless to say, this requirement also applies to other (nonpartnership) infrastructure projects.