1. Examining the Options: the Decision-Making Process

States have different ways to raise revenues to meet their infrastructure demands-and a wide variety of factors to consider. At the outset, a state should look at a concession agreement in the context of other methods of raising funds-a system-wide examination of options. Would hiking tolls be feasible without a concession? Is it advisable for the state to take on more debt? Can the gas tax be raised? Should there be a tax on vehicle miles traveled? Has the state examined all possible revenue sources before settling on any particular one? Every funding option will have impacts-on taxpayers; on drivers themselves, as they decide what roads to use and how much they drive; on businesses along the perimeters of roads; and on traffic congestion, public safety and long-term environmental conditions.

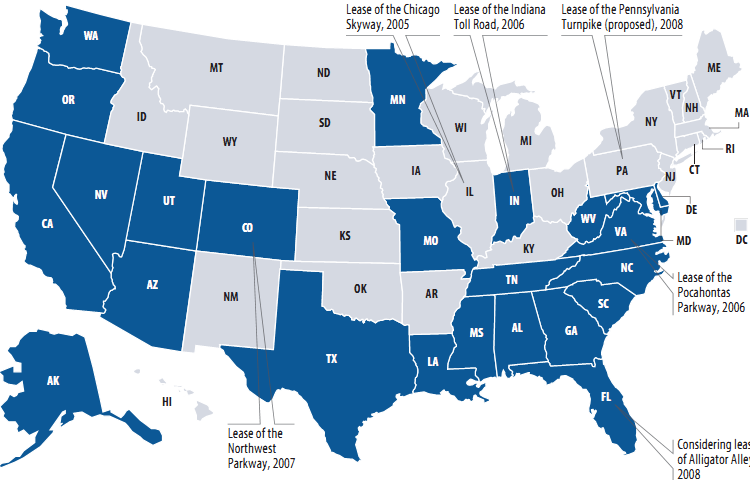

Exhibit 3 |

24 states (shaded) have enacted some sort of legislation to allow public-private partnerships for transportation.

|

SOURCE: Federal Highway Administration NOTE: Chicago has home-rule authority to lease its assets and as such did not need state legislation to lease the Chicago Skyway. Maryland does not have a statute expressly authorizing highway public-private partnerships; however, it established a public-private partnership program by regulation. Additionally, according to a 1996 state Attorney General opinion, the Maryland Transportation Authority has authority to construct toll roads using certain forms of PPPs. |

Assuming that a decision is made to partner with the private sector, there are still many choices to make about the most appropriate deal. Each type of partnership carries its own set of issues and will be more or less appealing depending on the government's goals. Is the main object to raise money? Or is it to provide a more efficient means for service operation? Is an immediate infusion of upfront cash needed to fund current infrastructure plans? Or does the state prefer to ensure a stable, long-term source of maintenance dollars? The complexity of these deals requires that state leaders in both the executive and legislative branches receive substantial education about the advantages and risks of each.

Ideally, the pros and cons of public-private partnerships should be weighed apart from the specifics of any particular deal. This kind of upfront examination is crucial for successful implementation of a public-private partnership. According to Deloitte Research, a firm specializing in private sector analysis, governments interested in pursuing these deals should put into place the legislative and regulatory framework needed to guide the contracts-because "[A] poor legislative and statutory environment will stymie a government's efforts to engage in [public-private partnerships]."46 Nearly half the state legislatures have approved statutes to authorize public-private partnerships, signaling their willingness to accept the concept should the right deal emerge.47 (See Exhibit 3 on page 16.)

States considering public-private partnerships should have clear, data-driven answers to these questions: |

• Does the government have a clear sense of the funding gap in its infrastructure needs? • Have all revenue options been examined and compared, both with and without private-sector involvement? • Is there understanding and agreement about the goals of raising revenue and the ways in which dollars will be distributed among projects or needs? • Has the legislature adopted enabling legislation to signal its willingness to consider a concession agreement with the private sector? |