Revenues

Pennsylvania would have received a $12.8 billion upfront payment from Abertis/Citi. After paying off turnpike debt, the state expected to have $10.2 billion left to invest. It assumed a 12 percent annual return on its investment; that income would have been used to pay for infrastructure improvements.

A number of observers questioned the state's assumption of an annual 12 percent return, which Governor Rendell's administration cited as the 20-year average annual return of the Pennsylvania State Employees' Retirement System (SERS). "We were asked [by the administration] to use 12 percent because that was what SERS had achieved over the last 20 years," says Rob Collins, managing director of the infrastructure banking unit of Morgan Stanley, the state's advisor.73 SERS itself does not use that average to forecast its future returns but instead uses 8.5 percent, which is higher than the median 50-state assumption of an 8 percent return on states' pension fund investments as of December 2007, according to research by the Pew Center on the States.74 In an October 2008 assessment of the proposed lease, Moody's Economy.com reported that Pennsylvania would have needed an average annual return of 9.8 percent to fund $1 billion in annual infrastructure spending.75 That return would be difficult to achieve, according to Moody's; the recent decline in the stock market affirms that belief. In fact, had the deal gone through, it is difficult to know how much the state would have lost on its investment in the last year, because although it used the pension system returns as an assumption, it would not have been required to invest the concession payment in that particular fund.

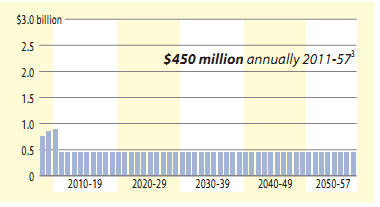

Lawmakers considered the lease in comparison to Act 44, which is projected to generate more than $1 billion annually for the state if tolling is allowed on I-80-but only $450 million a year if it isn't. If the invested concession payment achieved a rate of return of less than 12 percent, the lease deal would raise less money for Pennsylvania than Act 44 with I-80 tolling, but more without it. (See Exhibit 6 on page 30.)

Exhibit 5 |

While most American concessions run between 75 and 99 years, their upfront payments differ substantially. Chicago and Indiana allowed tolls to be raised more aggressively than the Pennsylvania lease would have allowed, and the Northwest Parkway and Pocahontas Parkway deals traded smaller upfront payments for the possibility of revenue sharing in future years. |

DEAL | YEAR ENACTED | ROAD LENGTH (MILES) | LEASE LENGTH | REVENUE SHARING | UPFRONT PAYMENT |

Pennsylvania Turnpike (proposed) | 2008 (proposed) | 531 | 75 years | No | $12.8 billion |

Chicago Skyway | 2005 | 7.8 | 99 years | No | 1.83 billion |

Indiana Toll Road | 2006 | 156.9 | 75 years | No | 3.8 billion |

Pocahontas Parkway (Virginia) | 2006 | 8.8 | 99 years | Yes | 548 million |

Northwest Parkway (Colorado) | 2007 | 11 | 99 years | Yes | 543 million |

French concessions1 | 2006 | 4,654 | 30 years | No | 53.9 billion2 |

Highway 407 - Toronto, Canada | 1999 | 74 | 99 years | No | 2.5 billion3 |

Autostrade - Italy | 1999 | 2,118 | 29 years | No | 6.7 billion3 |

1. Includes three separate concessions of the French autoway system: Autoroutes Paris-Rhin-Rhone; Societe des Autoroutes du Nord et de l'Est de la France; and Autoroutes du Sud de la France. Lease length is approximate. 2. Assuming exchange rate at the time of 1 Euro to $1.18. 3. Assuming 1999 exchange rate. SOURCE: Pennsylvania Turnpike Concession and Lease Agreement, www.dot.state.pa.us/internet/paturnpikelease.nsf/PATurnpikelease; The Chicago Skyway Sale: An Analytical Review, NW Financial Group (May 1,2006); Indiana Toll Road Concession and Lease Agreement (April 12, 2006); Transurban open letter, "RE: Pocahontas Parkway Association Public-Private Partnership" to the Virginia Department of Transportation (May 2, 2006); United States Government Accountability Office, More Rigorous Up-front Analysis Could Better Secure Potential Benefits and Protect the Public Interest (February 2008); Germa Bel And John Foote, working paper, Comparison of Recent Toll Road Concession Transactions in the United States and France (November 2007) available at http://www.pcb.ub.es/xreap/aplicacio/fitxers/XREAP2007-11.pdf (accessed January 13, 2009); Daniel Albalate, Germa Bel and Xavier Fageda, Privatization and Regulation of Toll Motorways in Europe (Irea Working Papers, University of Barcelona, Research Institute of Applied Economics, March 2007); Giorgio Ragazzi, "Are highways best run by concessions? The Italian experience," World Transport Policy and Practice, 12, No. 2 (2006). |

Pennsylvania's financial assumptions were overly optimistic. It is unlikely that the state would design another proposal using such a high rate of return in today's fiscal climate. Without such an assumption, however, the state would need a larger upfront payment that could generate sufficient income to support its infrastructure needs. It could shift some of its other parameters-to allow for larger toll increases, for example-to attract higher upfront bids.

Because the Rendell administration capped future toll increases prior to requesting proposals, Abertis/Citi could have raised tolls annually by 2.5 percent or the Consumer Price Index, whichever was greater. That cap likely factored into the bids coming in lower than expected, leading some policy makers to question whether the deal generated sufficient value. "From Senator White's perspective, the number was so underwhelming that it sunk interest in the deal right out of the gate," says Joe Pittman, chief of staff for Senator Don White, a Republican who serves as vice chair of the Senate Transportation Committee and opposed the lease.76

The state's decision to pursue a 75-year lease of the Pennsylvania Turnpike would have afforded Abertis/Citi preferred federal tax treatment, which generally allows for a higher upfront payment from the concessionaire. According to the turnpike's financial statements, its depreciation value was more than $200 million in 2007.The Turnpike Commission, as a public entity, pays no federal income taxes and thus receives no federal tax benefits to offset that depreciation.77 While we cannot quantify how much of the Abertis/Citi bid stemmed from the tax savings the companies would have enjoyed under the deal, it was almost certainly a factor in their calculations.

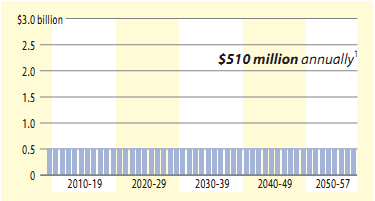

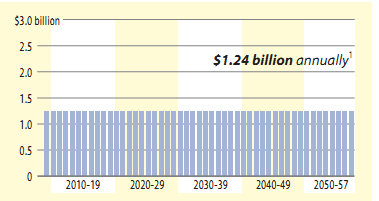

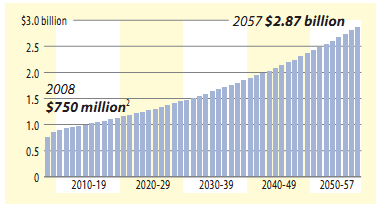

Exhibit 6 |

Pennsylvania policy makers compared a proposed lease of the Pennsylvania Turnpike with Act 44, which would provide new transportation funding through increased tolls on the turnpike and new tolls on I-80. Without the I-80 tolls, which have not been approved by the Federal Highway Administration, Act 44 would likely generate less funding for transportation than investing the principal from a lease. But with I-80 tolls, Act 44 would produce more revenue. |

5%LEASE-INVESTMENT RETURNS

| 12% LEASE-INVESTMENT RETURNS

|

1. 5 percent and 12 percent annual returns assuming the state would have invested an estimated $10.2 billion principal from the upfront payment on a lease of the Pennsylvania Turnpike and would not spend the principal over the term. The state used a 12 percent assumption because the State Employees' Retirement System had achieved 12 percent annualized returns over the previous 20 years. Morgan Stanley, the state's advisor, also modeled 5 percent annual returns as a point of comparison. The chart runs through 2057, the lifespan of Act 44. | |

ACT 44WITH I-80 TOLLING

| ACT 44WITHOUT I-80 TOLLING

|

2. The Act 44 payment schedule included payments of $750 million, $850 million and $900 million in 2008, 2009 and 2010, respectively, which would be generated through increased Pennsylvania Turnpike toll revenue and debt. Payment schedule assumes a 2.5 percent increase each year after 2010, financed in part through newtolls on I-80. | 3. The Act 44 payment schedule included payments of $750 million, $850 million and $900 million in 2008, 2009 and 2010, respectively, which would be generated through increased Pennsylvania Turnpike toll revenue and debt. If I-80 tolls are not in place in 2011, the annual Act 44 payments will drop to $450 million each year. |

SOURCE: Pennsylvania Turnpike Commission; Pew Center on the States calculations