1.1.1 Definition and Explanation of Optimism Bias

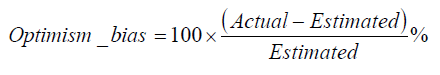

Optimism bias is the tendency for a project's costs and duration to be underestimated and/or benefits to be overestimated. The Mott MacDonald study has attempted to measure several types of optimism bias (i.e. works duration, project duration, capital expenditure, operating expenditure, unitary payments and benefits shortfall) within the projects studied. Optimism bias is defined as a measure of the extent to which actual project costs (capital and operating), and duration (time from business case to benefit delivery (project duration) and time from contract award to benefit delivery (works duration) exceed those estimated. It is also a measure of the degree by which the benefits delivered by a project fall short of the benefits estimated. Optimism bias can be represented as follows:

An assessment of the typical optimism bias levels in the public sector provides an indication of the level of confidence within estimates of project costs (excluding the effects of inflation and change in taxation), duration and benefits. All projects involve risk, which implies a cost to the bearer of that risk. Risk management in the public sector should aim to eliminate those issues that cause cost and time overruns, and benefit shortfalls. The project costs (capital and operating expenditure and unitary payments), duration or benefits are considered optimistic when they do not fully reflect the chances of cost and time overruns or shortfalls in the delivery of project benefits.