3.3.1. Number of bidders

Authorities ran effective competitions for the projects surveyed. Although the level of competition has reduced over time, it is still sufficient to deliver value for money. |

On average nine pre-qualification submissions were received per project, indicating strong competition. The minimum number of bids received was two, and this only occurred in one case. Pre-qualification for the projects in this survey, all of which are now operational, took place between 1995 and 20009. There is no evidence of a downward trend in the number of bids per project received during that period.

Fewer pre-qualification submissions were received in the health sector than in other sectors, possibly reflecting the relatively low capital values of many of the projects.

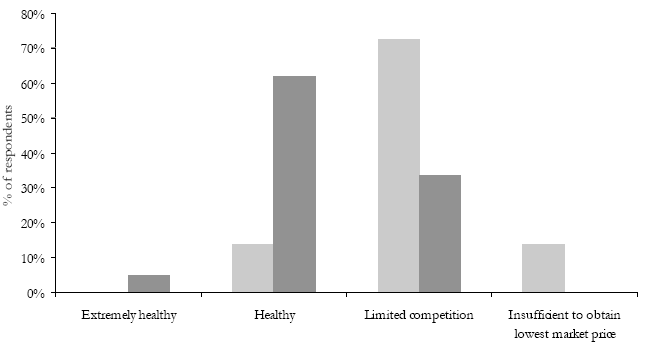

When considering the current situation, authorities and contractors alike said that they believed that the number of pre-qualification bids had fallen in recent years (see Figure 4 below). Authorities had some concerns that this meant that there was now limited competition and three respondents thought that competition was insufficient to obtain value for money. Contractors noted that the reduced number of bidders was partly due to the scale of recent projects, with smaller contractors unable to compete and the field reduced to the serious contenders.

Figure 4: Do you believe that there is currently a healthy level of competition for PPP contracts in your sector?

In our view, provided that the number of pre-qualification submissions from consortia that demonstrate the technical, financial and commercial capacity to complete the project does not fall below two to three genuinely competing bidders, there remains sufficient competition to demonstrate value for money. Where there is evidence of very little competition, at worst a sole bidder, or two bidders but a suspicion that one has agreed to drop out late in the game, then a lot more attention must be given to pre-bid value for money. The greater self-selection of bidders can benefit authorities as it reduces evaluation costs incurred reviewing non-credible submissions.

Lack of co-ordination between projects inhibits competition. |

In interviews, contractors commented on the lack of co-ordination between projects. Given the resources needed to bid, they said that they chose carefully which projects to go for, and then expected to bid aggressively for those projects. This approach by contractors should ensure that authorities receive good value for money, although it is important to ensure that there is no collusion between contractors over which projects each will bid for (there is no evidence or suggestion that this has happened to date).

The Scottish Executive already provides information on its website about the PPP project pipeline. But Scottish PPP projects compete with PPP projects around Europe, as well as with other construction work, in particular regeneration work taking place in Scotland. In addition to capacity constraints in the construction industry, there may be constraints on the number of PPP projects that the SPV management teams within construction and maintenance companies can take on. In interviews, authorities noted that, as the SPV shareholders' portfolio of projects grew, they were committing less time to the earliest projects. It was not clear from our discussions the extent to which constraints on bidding and construction capacity were physical constraints, or the result of relatively low capitalisation and therefore inability of companies to take on more risk.

Recommendation: The Scottish Executive / Departments / Local Authorities should continue to monitor the number of pre-qualification submissions received from credible consortia for new procurements to satisfy itself that competitive tension is being achieved.

There is perceived to be less competition for PPP projects than for non-PPP projects. |

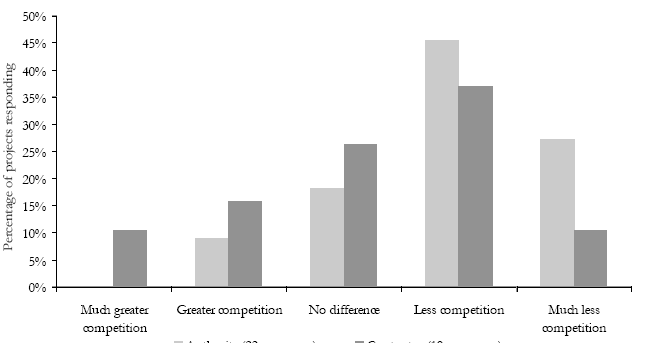

73 per cent of authorities thought that there was less or much less competition for PPP projects than for non-PPP projects (see Figure 5 below). This is probably partly explained by the fact that non-PPP projects tend to be smaller and therefore there are more contractors who have the capacity to take them on. But the general perception was shared by a health board with recent experience of procuring new large-scale assets under Design and Build contracts rather than PPP contracts; they believed that construction companies were more eager to bid for their work than for comparable PPP contracts coming to market at the same time.

Figure 5: How do you think competition for PPP contracts currently compares with competition for non-PPP contracts?

______________________________________________________________

9 1989 in the case of the Skye Bridge project, which was a PPP style project but preceded the private finance initiative.