3.3.2. Price movements between selection of preferred bidder and financial close

On more than half of projects, the price changed at the preferred bidder stage because of a change to the design or service specification. |

Based on responses from authorities and contractors, the price moved on 69 percent of projects (24 projects out of 35 that responded), with a total of 66 individual price changes reported. Figure 6 and Figure 7 below show the reasons for the changes and who initiated them. In the majority of cases the design changed and there was also a change to the services specification. Other reasons for price changes included correction of errors in the financial model, cost increases following funder due diligence, cost increases to compensate for delays in reaching financial close and the impact of negotiation by the authority.

Figure 6: Changes to the contract price

Reason for price change | Number of price changes |

Interest rate change | 15 |

Design specification change | 20 |

Services specification change | 18 |

Other changes | 13 |

Changes were only initiated by the contractor in 4 cases. Most of the time the authority led the change or it was jointly agreed.

Figure 7: Who led the change?

Price change led by… | Number of price changes |

14 | |

4 | |

Both Authority and Contractor | 32 |

Note that several respondents stated that there was a price change but did not state who led the change

The PPP procurement process aims to limit movements in the contract price during the period between selection of a preferred bidder and financial close. This is to ensure that value for money achieved during the competitive phase of the project is not eroded. Typically the interest rate risk during this period is retained by the public sector since it would not be cost effective to ask the private sector to take this non-controllable risk, and the price is adjusted to reflect any changes according to a pre-agreed mechanism10. Significant price changes at this stage which are triggered by a change to the design or to the services specification need to be minimised, and evaluated carefully to ensure that value for money is achieved in these non-competed additions to the original specification.

The scale of price changes appears significant and should be monitored. |

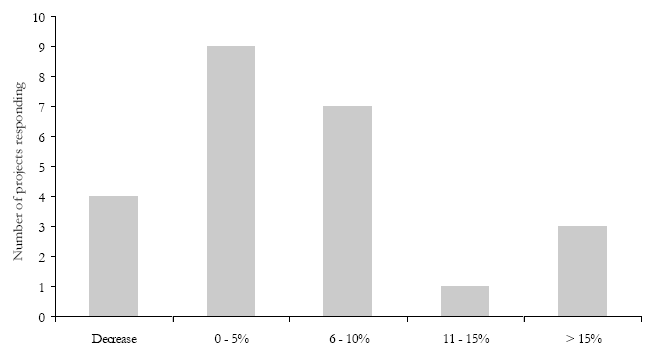

Figure 8 below shows the price movements recorded at preferred bidder stage as a percentage of contract NPV. The price increased by more than 5 percent in 11 of the 24 projects where the size of the change was reported.

Figure 8: Percentage change to the NPV of the contract

The scale of the price movements at preferred bidder stage could raise concerns about value for money, since the only competitive pressure at this stage of procurement is the relatively weak threat that the second placed bidder could be re-introduced into the competition (or, perhaps, the threat of cancellation of the procurement process). Note, though, that we are not able to identify separately the percentage change that related to interest rate risk taken by the authority and it is quite possible that an increase in interest rates, of say 1 percent, could increase the NPV by more than 5 percent11.

It is certainly better to agree changes at this stage rather than post financial close. But authorities should aim to introduce any design or service changes before inviting best and final offers, and the Scottish Executive should monitor the scale of changes at preferred bidder stage. As the use of standard contracts increases, and authorities' experience in developing designs and service specifications grows, we would expect to see the size of price changes made after selection of a preferred bidder decreasing, other than those relating to changes in the interest rate.

Recommendation: The Scottish Executive should continue to monitor the size of and reasons for price changes that happen during the procurement period.

______________________________________________________________

10 The public sector may be more exposed if the project will be bond-financed since, unlike in the case of bank debt, the margin on the bond is not pre-fixed.

11 For example, increasing the interest rate from 7 percent to 8 percent would increase each annual repayment on a 25 year annuity by 9 percent. Even after discounting at 6 percent real, the increase in NPV could well be greater than 5 percent.