INNOVATIVE CAPITAL FINANCING

The term "innovative financing" is often used to describe a new approach to funding capital by using traditional finance tools in different ways. The idea behind innovative financing is not only to increase the amount of dollars available for infrastructure, but to compensate, control, and even reverse some of the powerful incentives and drivers that fuel infrastructure deficits.

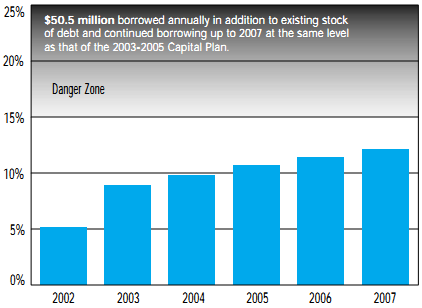

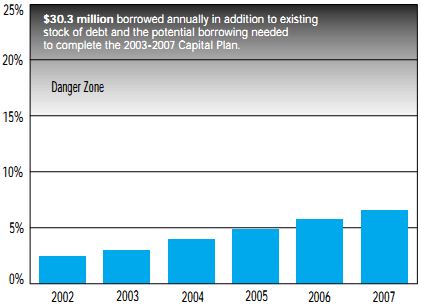

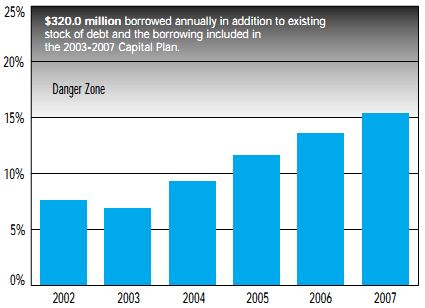

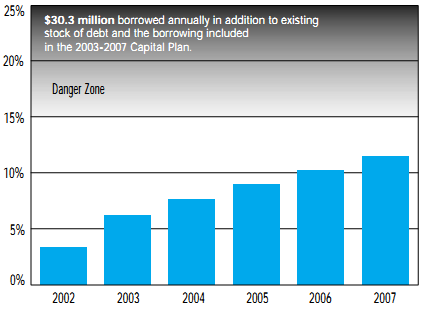

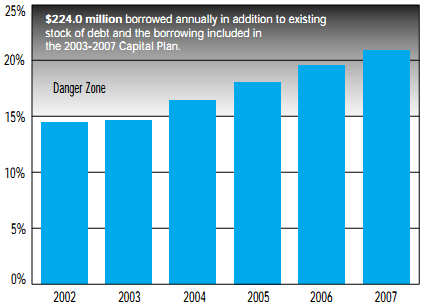

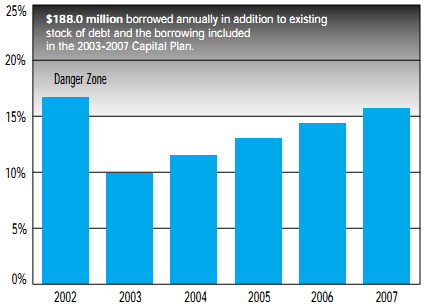

FIGURE 14: Debt Service Charges as a % of Operating Revenues if Infrastructure Deficits were Eliminated by Borrowing

| VANCOUVER

| SASKATOON

| |

| EDMONTON

| REGINA

| |

| CALGARY

| WINNIPED

| |

SOURCE: Derived by CWF from Cities' Annual Financial Reports and the current Capital Plans. Debt servicing costs (principal and interest) of existing debt over the next five years were first totalled and then averaged to yield a debt servicing cost for existing debt. Added to this total is the borrowing as outlined in each city's Capital Plan and borrowing to fully fund the reported infrastructure deficit in each city. Interest on new debt is 6.5% over a 20 year term. It is assumed that principal and interest is paid monthly, similar to a conventional mortgage.