Adverse impact on Loss Given Default (LGD)

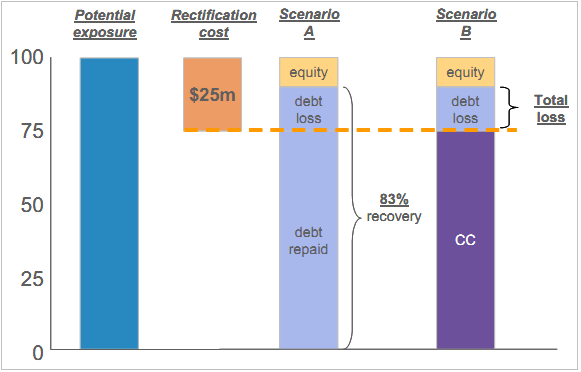

Consider two funding options for $100m of construction works. In Scenario A, funding comprises $10m of equity and $90m debt. In Scenario B, equity is held constant at $10m but the balance of funding is split between $75m CC and $15m senior debt. The CC is contributed during the construction phase, lowering the overall requirement for private sector funding.

Now consider the impact of a typical default where the gross rectification costs are $25m (after all other protections have been exhausted).

▪ In Scenario A, rectification costs of $25m are sufficient to wipe out all the equity and crystallize a $15m loss for senior debt. Senior funders still recover $75m on exposure of $90m, and this leads to a typical 83% recovery2

▪ In Scenario B, rectification costs wipe out all the equity as before, but the remaining $15m loss is sufficient to deliver a 100% loss on senior debt.

While this may seem an extreme example, we have seen and rated such a case - although the resulting rating was low and has never been published. In our view, the impact of the CC was sufficiently adverse to transform a conventional senior debt exposure into an instrument which bore some characteristics of subordinated debt, and was rated accordingly.

_____________________________________________________________________________________________________________________

2 Moody's Special Comment: "Default and Recovery Rates for Project Finance Debts, 1992-2008", published in November 2009, highlighted an average 82% observed recovery rate across defaulting debts, with a much higher LGD for subordinated tranches.