Adverse impact on Loss Given Default (PD)

In the previous example, Scenario B was unusual because the equity funding level was unchanged, resulting in a modest level of gearing. In practice this is rare - much more likely is that issuers will look to rebalance the relationship between debt and equity towards the more typical 90/10 gearing ratio shown in Scenario A.

So consider a further funding variant, Scenario C. Like Scenario B, there is a $75m CC but the issuer has reduced equity from $10m to $5m, with senior debt funding the balancing $20m. Gearing is now 80/20, lower than Scenario A which some might see as a relative strength (since gearing is a conventional and widely used metric for credit quality); however in absolute terms the equity funding contribution is lower 3 4

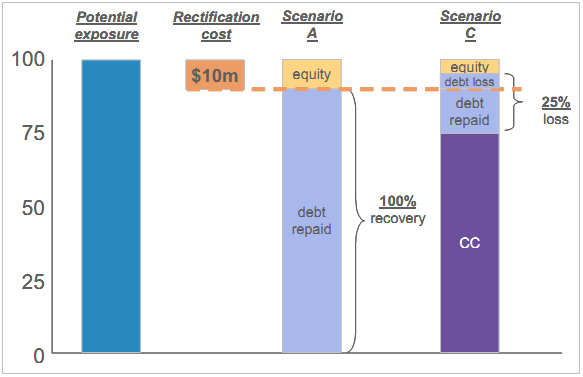

This time around the gross rectification costs are lower at $10m (after all other protections have been absorbed).

▪ In Scenario A, rectification costs of $10m are sufficient to wipe out all the equity, but nothing more. Senior funders avoid a default and achieve 100% recovery.

▪ In Scenario C, rectification costs wipe out all the equity as before, but the remaining $5m loss is sufficient to create a 25% loss on senior debt.

The lower absolute level of equity means that there will be stress scenarios which will lead to a default and loss under Scenario C, which would have been borne solely by equity with no senior debt default in Scenario A. Senior debt in Scenario C therefore carries a higher Probability of Default than Scenario A.

______________________________________________________________________________________________________________________

3 Conventional credit analysis of funding sources should identify $5m as an unusually modest funding contribution towards $100m of project costs; if gearing was expressed as 95/5 this weakness would be more obvious. However presentation of an 80/20 gearing calculation based only on private sector funding sources masks the more limited nature of the equity contribution relative to overall project costs.

4 Similarly, a lower equity injection should lead to more modest equity cashflow returns during the operating phase. This would increase a project's operational gearing and might make it more likely to default in a cost overrun or revenue reduction scenario during the operating phase.