CATCHING UP

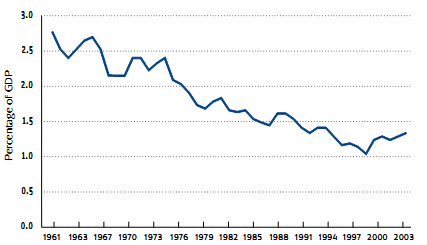

Since 1961, the percentage of investment in public infrastructure has been declining as a percentage of GDP, according to the Building Canada report. The percentage of GDP invested nearly 50 years ago was almost 3.0 percent whereas, in 2003, it stood below 1.5 percent (see graph below left).

TOTAL INVESMENTS BY ALL ORDERS OF GOVERNMENT

Investment in public infrastructure has been declining as a percentage of GDP

Source Department of Finance Canada

The idea that Canada has under-spent on its infrastructure is shared by some in the economic community.

Glen Hodgson, senior vice-president and chief economist with the Conference Board of Canada in Ottawa, says: "Canada's public infrastructure has been systematically under-invested for a long time…and we're finally in catch-up mode." He goes on to state that fiscal deficits and the need to balance the books in the 1990s prohibited the federal and provincial governments from taking action and there were simply no infrastructure issues pressing enough to tackle head-on. "We're very good in Canada at waiting until we have a burning problem," he adds.

Others in the industry agree. Sam Pollock, chief executive officer of Brookfield Infrastructure Partners and senior managing partner at Brookfield Asset Management, a global infrastructure and real estate developer based in Toronto, says: "There has been substantial under-investment in infrastructure in Canada and other developed countries over past decades. In many developed countries, major infrastructure projects were built during the World War II post-war boom and are in urgent need of upgrade or replacement."

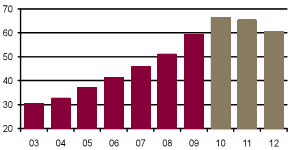

However, that is changing. According to the Conference Board of Canada, the government has increased its capital formation spending from approximately $30 billion* in 2003 to about $65 billion in 2010 (see chart below right). And while this is set to decline somewhat in the years to come, Hodgson says it will remain high. "We were already doing this before the global financial crisis. We realised collectively that we had to do more. There are cities that have degradation in their water systems, so there has been a great spurt in spending on infrastructure… It's going to wane a little bit as the whole infrastructure spending programme slows but it will stay at a fairly high level because there really is a need for catch-up," he adds. developments in the financial sector have contributed to the waxing and waning of infrastructure spending. "One of the most important trends affecting Canada presently is the budget deficits affecting certain provinces. This has resulted in the delay of projects in some provinces and a review of project structures in others, with a particular focus on reducing long-term financing costs. That said, we remain very bullish on the Canadian market," notes Matt Giffen, managing director, head of global energy solutions and co-head, global infrastructure finance with Scotia Capital in Toronto.

GOVERNEMNT FIXED CAPITAL FORMATION ($BILLIONS OF CURRENT DOLLARS, 2003-12)

Source: The Conference Board of Canada; Statistics Cananda