A SAMPLE VfM ASSESSMENT: THE DURHAM CONSOLIDATED COURTHOUSE

Before addressing the specific factors discussed above, it is worth reviewing an example of a VfM assessment. These assessments, which are usually undertaken for each P3 project as part of the procurement process, involve a detailed comparison of the total costs of both the P3 and conventional procurement options on an ex ante basis. VfM studies constitute the key public interest test as to whether the infrastructure procurement should proceed as a P3 (or be modified or proceed as a conventional project) The role of VfM studies in the procurement process for the second wave of P3s is discussed in Chapter 4.

| VfM studies constitute the key public interest test as to whether the procurement should proceed as a P3. |

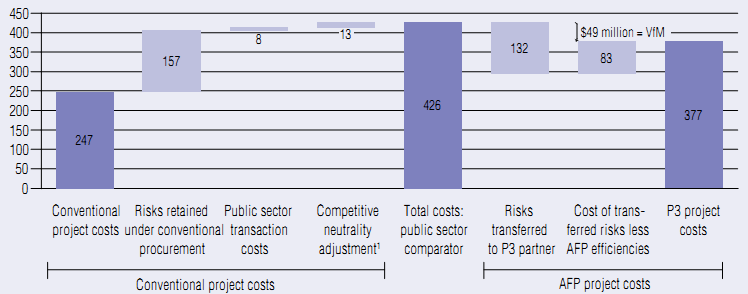

The Durham Consolidated Courthouse (DCC) was one of the first second-wave projects procured by Infrastructure Ontario as an alternative financing and procurement (AFP) project. The left-hand side of Chart 1 shows the estimated cost of undertaking the design, construction, financing, and maintenance of the DCC over a 30-year period using a conventional procurement process-that is, a succession of conventional design, construction, and service contracts. These costs were estimated at $247 million in 2007 dollars, but the VfM methodology- discussed in Chapter 4-also involves quantifying the risk exposure retained by the public sector under this conventional approach. These are the risks that typically lead to cost and budget overruns in public infrastructure projects, and this risk exposure was estimated at $157 million. In addition, the total costs of implementing the DCC project using a conventional procurement included the transaction costs incurred by the public sector-that is, $8 million in project management and advisory costs-as well as a "competitive neutrality" adjustment of $13 million that took into account public sector revenue that would arise under the P3 but not under conventional procurement (e.g., tax revenues). These four cost components are the inputs into what is called the public sector comparator (PSC), that is, the total costs of procuring the DCC facility and maintenance services through a conventional procurement over the 30-year life of the facility.

The right-hand side of Chart 1 shows the total project costs under the AFP approach, based on the agreement signed with the private sector consortium, Access Justice Durham. It also shows how the AFP project costs compare with those of the PSC. First, we note that the AFP project involves a transfer of risks estimated at $132 million in 2007 dollars to the private consortium. In other words, most of the risk exposure that would have been retained by the public sector under a conventional pro-curement approach is transferred to the private consortium. The public sector retains exposure to project risk estimated at $25 million. Chart 1 also shows that the cost of transferring the risk exposure to the private consortium less the value of any efficiencies resulting from the AF procurement approach is $83 million. Specifically, the $83 million captures the following components:

| Chart 1 Comparing Conventional and AFP Procurements - the Durham Consolidated Courthouse (2007 $ millions)

1 This adjustment includes items such as taxes paid under the P3 contract that flow back to the public sector but which are not taken into account in the conventional approach. Source: Infrastructure Ontario, Value for Money Assessment: Durham Consolidated Courthouse. |

♦ the risk premium, which is the cost to the public sector of the additional risks assumed by the private consortium;

♦ the incremental cost of the private financing under the AFP approach;

♦ the incremental transaction costs borne by the private consortium, including any provisions for covering its bid costs on losing bids;

♦ the incremental transaction costs borne by the public sector, which include due diligence and other advisor costs; and

♦ the value of any other efficiencies resulting from the AFP procurement approach (e.g., efficiencies arisin from combining the design, construction, and maintenance phases).6

|

The VfM estimate captures both the savings arising from the transfer of risks and any other efficiencies arising from the AFP procurement. |

The total cost of the DCC project under the AFP approach is $377 million, including the risk exposure retained by the public sector. This represents a VfM savings of $49 million relative to the total cost of the DCC under a conventional procurement approach (i.e., the PSC at $426 million). The VfM estimate captures not only the savings or efficiencies arising from the transfer of risks to the private partner but also any other efficiencies resulting from the AFP procurement. The total cost of the DCC project under the AFP approach can also be calculated from the PSC by removing the risk exposure transferred to the private consortium ($132 million) and adding the cost to the public sector of transferring these risks ($83 million).7

___________________________________________________________________________________________________________

6 The VfM assessment of the DCC project enables us to identify the incremental transaction costs borne by the public sector as $9 million in 2007 dollars, or 2.1 per cent of the PSC budget. The four other components of the $83-million figure amount to $74 million, but cannot be broken down further.

7 Calculations are subject to rounding errors.