ONTARIO: THE SUDBURY REGIONAL HOSPITAL (PHASE 1) AND THE QUINTE HEALTH CARE AFP

The Quinte Health Care (QHC) project was one of the first hospitals built in Ontario to be procured as an alternative financing and procurement project. It is also one of the first of 20 build-finance hospital projects to have been undertaken by Infrastructure Ontario, with substantial completion expected by January 2010. The Sudbury Regional Hospital project (Phase 1) was chosen as a case study of a conventional approach to hospital procurement in Ontario, because it was the only such project for which we could find publicly available third-party documentation.

According to the report of the Health Capital Planning Review conducted for Ontario in 2004, the problems with the Sudbury Regional Hospital redevelopment project were not unique.14 The report suggested that the planning and procurement challenges were endemic to major hospital procurement projects across Ontario. Specifically, the report found that:

♦ there was inadequate attention to capital projects at the planning stage and a lack of standards and guidelines for the planning and procurement process;

♦ these problems occurred primarily with large capital projects (i.e., projects in excess of $1 million);15 and

♦ capital planning for long-term care facilities was better managed:

Financial risk is assessed early in the process and before any funding is provided to eligible operators, and managed by not providing funding until the facility is built and the Ministry is satisfied that it is ready to be occupied. The need to receive part of a facility's funds from the market provides market discipline.16

As a result, the report made several recommendations that included creating a separate capital planning agency and carrying out a business case and life-cycle costing analysis for all major hospital capital projects.17

The Sudbury Regional Hospital Capital Redevelopment Project (Phase 1)-Snapshot of a Conventional Hospital Procurement The capital development plans for the Hôpital régional de Sudbury Regional Hospital (HRSRH) were a product of the Ontario-wide Health Services Restructuring Commission (HSRC), which recommended closing the three acute-care hospitals in the region in 1996 (Laurentian, Memorial, and Sudbury General) and amalgamating all acute in-patient, rehabilitation, and chronic-care services at a renovated and expanded facility on the site of the original Laurentian hospital. The HSRC estimated the capital cost of this project at $85 million. The next few years were spent developing the proposal, functional program, preliminary designs, and procurement approach for the HRSRH redevelopment plans. By March 2000, the Ministry of Health and Long-Term Care (MoHLTC) had approved a budget of $143 million based on a construction management approach to the procurement. However, "with little experience of the construction management approach being sought by the hospital, [the MoHLTC] asked the [hospital] board to sign a waiver of liability [for cost overruns], which it did in February of 2000."1 By the end of Phase 1 of the project two years later, the entire budget had already been spent, but the total cost of the project (i.e., phases 1 and 2) had risen to an estimated $363 million, or over four times the amount originally estimated by the HSRC. The operational review of the HRSRH concluded in November 2002 that these cost and time overruns were due to lack of project "oversight and adequate supervision at all levels,"2 including: ♦ the lack of policies and procedures for capital planning and procurement; ♦ poorly specified tendering documents, which "resulted in unrealistic tenders being accepted";3 and ♦ inadequate project management, with the hospital lacking the resources and expertise to track the project outcomes and critically review the decisions made by the construction management firm. This problem was partly due to a province-wide policy at the time, which limited project management resources to $65,000, regardless of project size. ______________________________________________________________________________ 1 Canadian Healthcare Management and THiiNC iMi, Operational Review, p. 14. 2 Ibid., p. 15. 3 Ibid., p. 16. Source: Canadian Healthcare Management and THiiNC iMi, Operational Review. |

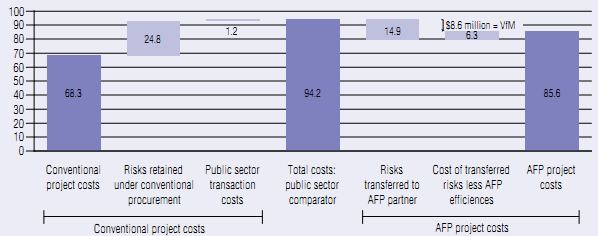

The Quinte Health care project-A Build-finance AFP project The Quinte Health Care (QHC) project had its roots in the amalgamation of the four Belleville-area hospitals proposed by the Health Services Restructuring Commission (HSRC). The capital project was approved for delivery as an alternative financing and procurement (AFP) project under the Ontario government's 2005-06 capital plan, which was part of the province's $30-billion infrastructure investment plan known as ReNew Ontario 2005-2010. The project involves adding a new wing to the Belleville General site (155,000 square feet) and renovating an additional 22,000 square feet. The total cost for this project under the AFP is $85.6 million, with the provincial government covering 90 per cent of the cost under the new hospital funding policy announced in June 2006. The risks transferred to the private sector contractor include: ♦ construction price certainty, based on a guaranteed maximum price of $72.2 million, including financing costs; ♦ project scheduling delays, based on QHC's payments to the contractor beginning at the point of substantial completion, which is expected in January 2010; ♦ design coordination risk, which refers to "the risk that change orders are required during construction due to design coordination/design completion/design gaps" that can be reasonably inferred.1 This risk was transferred even though the private partner was not responsible for the design of the facility, which was undertaken prior to the AFP project; ♦ financing risk; ♦ a schedule contingency, which shields QHC from the costs arising from up to 30 days of delays attributable to QHC; and ♦ commissioning and facility readiness. Some of the risks are shared between QHC and the contractor, including project scope changes by the owner and design errors and omissions. One key aspect of the project is the "change order protocol" agreed between Infrastructure Ontario and QHC.2 It sets out the principles governing any changes in project scope, including the "limited criteria under which change orders will be processed" and the conditions under which Infrastructure Ontario's approval is required.3 This protocol addresses an important source of cost overruns in conventional infrastructure projects. In addition, it provides a good example of an area where the project risks are mitigated by improved public sector management of the procurement process rather than being transferred to the private sector. The estimated VfM resulting from the AFP approach is $8.6 million or 9.2 per cent of the cost of the project using a conventional procurement approach. The chart summarizes how the VfM estimate is derived. Project costs under a conventional procurement approach consist of the conventional project costs (or the base project cost, which is the same under the AFP approach) of $68.3 million, the project risks retained by the public sector under a conventional procurement, which are valued at $24.8 million, and the transaction costs borne by the public sector ($1.2 million), for a total of $94.2 million. Under the AFP approach, 60 per cent of the risks retained by the public sector under a conventional procurement are transferred to the private contractor (i.e., $14.9 million). The cost of transferring these risks to the private contractor is $6.3 million. This sum is made up of the risk premium ($4 million) that the contractor requires for managing the additional risks and the incremental transaction costs incurred under the AFP approach ($2.3 million), which partly serve to carry out additional due diligence under the AFP approach. The result is an AFP project cost to the public sector of $85.6 million, which represents a savings of $8.6 million relative to the cost of the traditional approach. (Note that the difference between the $85.6 million figure and the $72.2 million capital cost paid to the contractor is the value of the risks retained by the private sector, $9.9 million, and the total transaction costs borne by the public sector, $3.5 million.4) As of December 10, 2009, the QHC project was 98-per-cent complete, with substantial completion scheduled for January 2010. The project has also been subject to contract variations and to claims against the public sector owner, but public sector spending has remained within the approved project budget of $85.6 million.

____________________________________________________________________________ Source: Infrastructure Ontario, Value for Money Assessment: Quinte Health Care Belleville General. 1 Altus Helyar Cost Consulting, "Infrastructure Ontario Build Finance Risk Analysis and Risk Matrix," p. 15. 2 This protocol is in addition to the provisions governing contract variations in the partnership agreement, some of which require lender approval (for changes greater than a pre-set threshold). 3 Infrastructure Ontario, Value for Money Assessment: Quinte Health Care, p. 13. 4 The $1.2 million in transaction costs referred to above are the estimated public sector transaction costs under conventional delivery. The public sector transaction costs under the AFP approach are $3.5 million. Source: Infrastructure Ontario, Value for Money Assessment: Quinte Health Care. |

___________________________________________________________________________________________________________

14 Decter, Health Capital Planning Review.

15 According to the Health Capital Planning Review report, the MoHLTC had 760 requests for capital funding, but only a small number of these (17 projects over $50 million each) "account for a large proportion of outstanding funding pressures." See Decter, Health Capital Planning Review, p. 15.

16 Decter, Health Capital Planning Review, p. 39.

17 Ibid., p. 28.