Pension funds at the ready

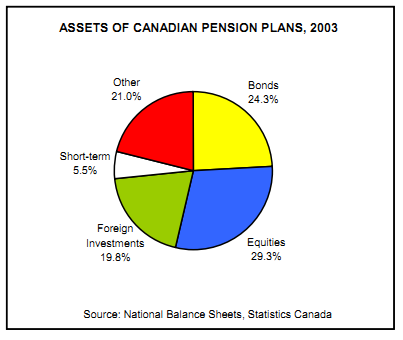

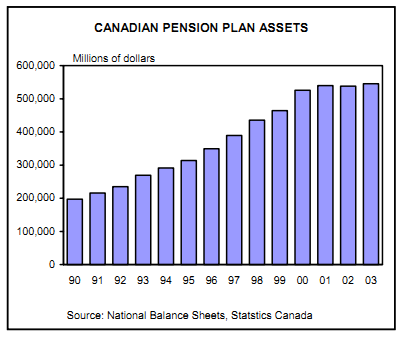

For the P3 market to truly get off the ground in Canada increased public-sector attention will only do so good -considerable private sector interest will be the other necessary ingredient. And, on this front, the country's large pension funds, who are armed with a whopping $800 billion in total invested assets, offer considerable potential to fill much of the gap.29 In fact, after suffering dismal stock-market returns over the past three years - which, in turn, led to significant increase in unfunded pension liabilities - some of the largest funds have already shown increased appetite for diversifying their asset holdings into non-financial investments. And, not surprisingly, pension funds whose members are retired public servants have shown particular interest in investing in public infrastructure. For example, both OMERS and the Ontario Teachers Pension Plan have indicated that they would like to allocate up to 10 per cent of their pension assets to this area in the future.

Indeed, infrastructure assets are particularly well suited to pension plans, since real asset returns provide an excellent match to pension benefits, which are indexed to inflation. Nevertheless, pension funds will not just be looking at domestic opportunities, but those abroad, so competition will be fierce. The federal government's recent decision to cancel a plan that would have imposed restrictions on pension funds from participating in the burgeoning income trust market will have been well-received in the pension industry.