Gas tax transfer not the way to go

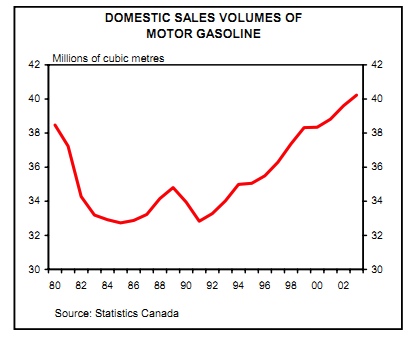

While the "year-end" commitment for more money was almost universally welcomed, some observers interpreted the use of the phrase "or equivalent" as a sign that the Prime Minister is backing away from his earlier promise to transfer a share of the gasoline excise tax. However, we were pleased to see that he has left the door open to other options for municipal financial assistance. As we argued earlier, such a revenue-sharing arrangement is, for all intents and purposes, a grant. Hence, it suffers from the same accountability problems, with citizens outside the community paying for the benefits enjoyed locally. Furthermore, from a reliability perspective, these taxes fail the test, since they're levied on the volume of consumption, which tends to grow only slowly over time. And, while there has been the argument put forward that gas-tax sharing for infrastructure purposes makes sense since it draws a direct link between car usage and transit needs, we would rebut that this is only superficially compelling. Federal excise taxes, along with their provincial counterparts, were not designed with transportation needs in mind, so the efficiency argument loses some of its muscle. Above all, the notion of transfering the gas tax is just a semantic trap. Given that all the government's revenue sources are "fungible", any funds transferred under the label of the gasoline tax are just as likely to come from, say, personal and corporate income taxes or the GST. In short, while we support increased funding for municipalities to help them combat their infrastructure challenges, we do not think that handing out a share of the gasoline tax is the best route to take.

Not only is it necessary for the federal government to make better use of the money, but to take a larger and more effective role than it presently does in tackling the nation's infrastructure challenges. The good news is that such a focus would not require much of a strategic shift for the federal government. Consider the major priorities laid out in the federal government's 2004 budget - health, learning (i.e., post-secondary education and innovation), communities, and Canada's relationship with the United States and position in the world. The need to upgrade infrastructure - from health facilities, to sewers to educational institutions and border crossings - spans all of these areas.