PFI Option

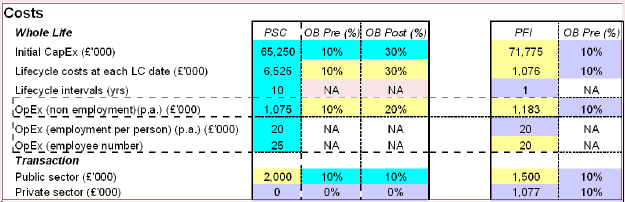

1.71 The Spreadsheet is set up in such a way that enables Procuring Authorities to test the proposition that PFI manages risks which typically emerge after the FBC stage more efficiently than is achieved through conventional procurement. This proposition relies on two testable factors. First, that more detailed (and more widely validated) project definition and development is completed at the FBC stage for the PFI Option. This is also reflected in the Spreadsheet through higher Transaction Costs for the PFI Option. Second, that, having reached contractual close, the PFI Option may deal more effectively, from the public sector's point of view, both with the risks that emerge and crystallise thereafter and, through contractual mechanisms that are more tightly calibrated with outputs, increases the probability that the benefits required from the project will be secured.

1.72 The Spreadsheet introduces a Default Value for the Post-FBC Optimism Bias Factor for the PFI Option of zero. This suggests that Post-FBC Optimism Bias for the PFI Option has fallen to the irreducible level (i.e. that which is common to all methods of procurement and which therefore, is not valued in the Spreadsheet). In other words, the Procuring Authority has very high levels of confidence that the costs and/or benefits required of the investment will be achieved or alternatively, it is confident that the contractual mechanisms are sufficiently strong to reduce, or even prevent altogether, payments being made by the Procuring Authority if specified benefits are not being produced. Both these propositions can be tested by studying comparable PFI projects and, particularly, those where the Operational Period has commenced.

BOX 1 A: Optimism Bias

|

1.73 The levels of Pre and Post-FBC Optimism Bias Factors will inevitably vary from sector to sector and from project to project. Optimism Bias values should be determined for all projects. Zero Optimism Bias is not appropriate and the Spreadsheet does not allow the user to insert 0% Optimism Bias values. Any estimates used should be informed by sector-specific experience and draw on cross-departmental experience where appropriate, but should be updated on a project specific basis. Through their Estates Agencies, a number of sponsoring Departments already maintain good records both of the movement in estimated costs of projects between the OBC and FBC stages and, particularly for conventionally procured projects, of subsequent changes to outturn costs (i.e. between the FBC and the completion of the relevant asset). Where information is not readily available Departments should determine what steps need to be taken to assemble a solid evidence base upon which to draw their sector-specific conclusions on Optimism Bias.

1.74 In 2002 HM Treasury commissioned Mott McDonald10 to conduct a cross-sector review analysing the variance between the estimated costs of large publicly funded projects at OBC stage and the outturn costs incurred, once the relevant assets had been completed. This report can provide Procuring Authorities with a useful platform upon which to base plausible planning assumptions for Optimism Bias, particularly for larger projects.

1.75 Equally though, Procuring Authorities may, from their own experience, already have a good understanding of the levels of Pre-FBC and Post-FBC Optimism Bias that typically affects projects similar to the one being assessed. The Spreadsheet provides Procuring Authorities with the scope to introduce their own estimates of Optimism Bias.

10 Mott MacDonald, Review of Large Public Procurement in the UK, July 2002