OBJECTIVE

In this part of the P3 business case, the sponsor should:

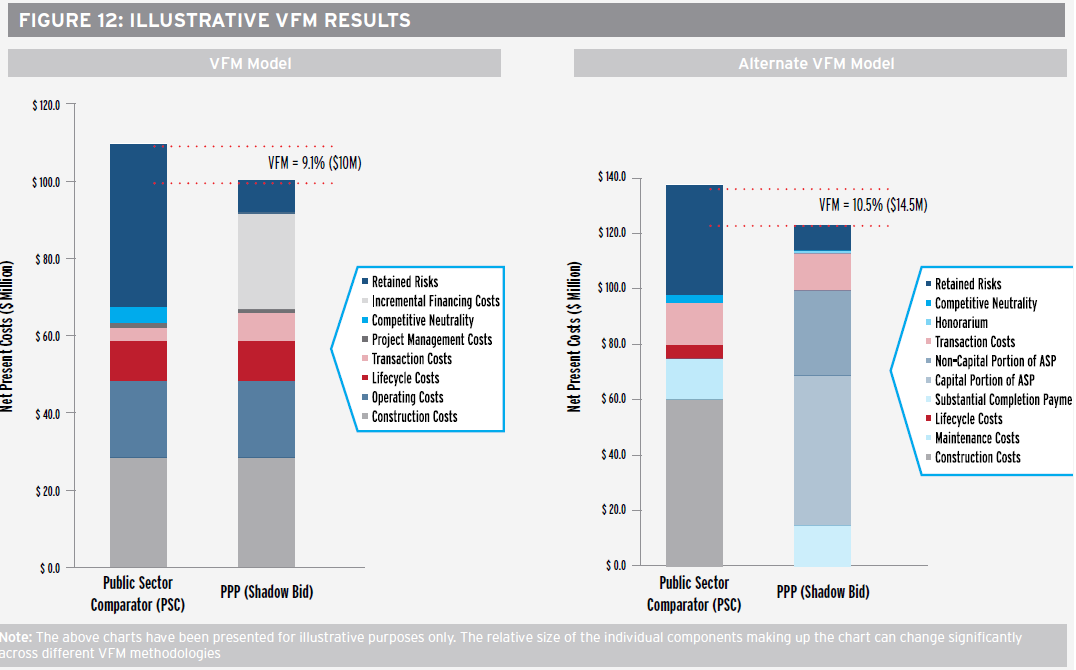

• Overlay the quantitative risk analysis over the cash flow models to arrive at risk adjusted net present costs of the PSC and Shadow Bid (see Figure 12 for illustrative VFM comparison of the PSC and Shadow Bid);

• Clearly disclose the discount rate used to calculate the net present costs and the methodology for determining the discount rate;

• Undertake a sensitivity analysis of the VFM results to assess how changes in certain variables affect the VFM achieved by the project. A high and low-end VFM assessment should be presented;

• Benchmark the VFM for its project to the VFM generated by similar projects using similar transaction structures; and

• Outline the points during project execution when the VFM analysis will be updated.