Service levels and deductions

When it comes to Service Level Agreements (SLA), the picture is similar to last year. Requirements are being met and deductions do not appear to be excessive. When problems have occurred, they have been resolved within the time allowed by the contract 'always' in 32% of cases, and 'most of the time' in 66%.

It is notable that of those that are monitored by the public sector client, only 44% reported very good relationships against 24% satisfactory or poor. Among those who used the private sector consortium SPV the 'very good' relationship percentage rises to 67%, against 22% satisfactory or poor.

In 53% of cases, the public sector has chosen to waive its right to impose deductions, although 39% of respondents have received deductions between one and five times. It appears that this right, however, remains more of a sanction than an active management tool. 34% of contracts have not been subjected to any performance or availability deductions, and of those that have, most have received just a handful - 51% less than ten and only 10% more than 50. Total deductions do not typically appear to represent any more than 0.5-1% of total revenues. This suggests either:

a) high quality delivery; or

b) questionable contract management by the public sector; or

c) poorly designed payment mechanisms.

It is also possible, that in practice, the private sector suppliers work to 'over deliver' in some areas in order to be able to minimise the impact of deductions and to protect relationships.

The impact of deductions on relationships is therefore hard to gauge. 13% strongly agree, and 51% agree to some extent that the imposition of deductions damages the relationship with the public sector - but 79% of respondents recorded good or very good relationships with their corresponding management team. The discrepancy implicit in these conflicting results suggests that any damage done to the relationship is short lived.

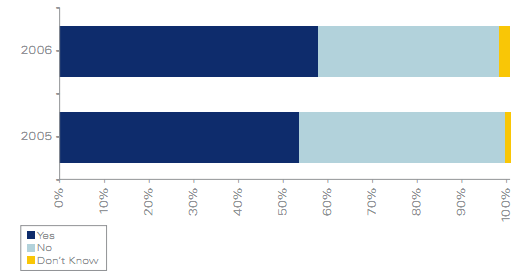

Has the contract been subjected to any performance or availability deductions?