The Government's spending plans

1.1 After the 2010 election the Government announced an immediate reduction in 2010‑11 spending from the levels set in the March 2010 budget. It announced further reductions to reduce the structural deficit over the 2010 Spending Review period to 2014‑15:

● The Government announced reductions totaling £6.2 billion in Total Managed Expenditure (see Figure 1) in 2010‑11. Some £500 million of the savings were re‑used for further education, apprenticeships and social housing. The reductions were shared with the devolved administrations, so net departmental spending reduced by £5 billion.

● The Government added some £32 billion of spending reductions by 2014‑15 to the £51 billion reduction implied by the March 2010 plans.

| Figure 1 Understanding Treasury spending plans

Source :HM Treasury |

1.2 Although individual spending departments and other public bodies must deliver the bulk of reductions, two departments play key central roles:

● The Treasury led the Spending Review 2010 exercise to plan departments' spending during the period 2011‑12 to 2014‑15. It also monitors overall spending and reviews departments' requests for additional funds from Parliament. The Treasury's approach to the Spending Review focuses on departments keeping within their agreed spending allocations. However, the Treasury expects improved value for money to be important in making sure that spending reductions do not simply lead to proportionate cuts in front‑line services.

● The Government formed the Cabinet Office's Efficiency and Reform Group in May 2010 to help departments cut costs centrally in key areas such as civil service staffing, procurement, estates and process efficiency.1 Its role includes approving specific departmental spending proposals in key areas such as staff exit programmes, consultancy, accommodation, media and marketing and major capital projects.

1.3 The Government's spending plans as set out in its annual budget reports, and in the Spending Review, reflect the impact of proposed policy changes. The plans also allow for likely cost pressures in the period including both general inflation, and specific factors such as the increasing numbers of elderly people and the likely impact of wider economic conditions on welfare and tax credit spending.

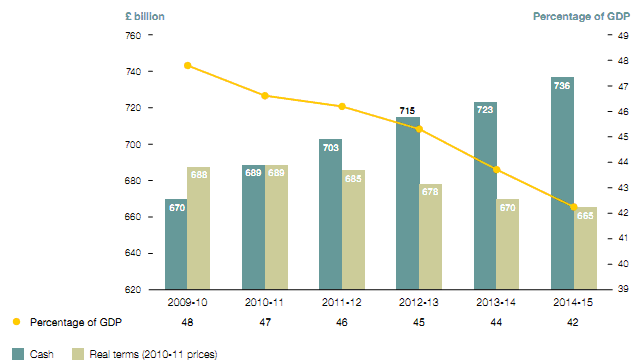

1.4 The Government established the Office for Budget Responsibility (OBR) in 2010 in order to independently assess the public finances. Its latest forecast, in the 2011 Autumn Statement, was for Total Managed Expenditure (Figure 1) to increase from £689 billion in 2010‑11 to £736 billion in 2014‑15. In cash terms this represents an increase of 7 per cent, but a fall of 3 per cent in real terms.

1.5 Owing in significant part to the Government's planned fiscal consolidation, the OBR expects Total Managed Expenditure to fall during the 2010 Spending Review period from 47 per cent of the gross domestic product (GDP ‑ the most commonly used measure of the overall size of the economy) to 42 per cent by 2014‑15 (Figure 2). Its latest assessment, included in the Autumn Statement 2011, is that despite slower than expected growth, public sector net borrowing will fall from its current level of 9.3 per cent of GDP to 4.5 per cent during the period. However, its predictions depend on wider economic developments particularly in the Euro area.2 If the economy fails to grow even at the lower rate now predicted, Annually Managed Expenditure may rise as a share of GDP, whilst tax receipts may be lower than forecast.

| Figure 2 Total Managed Expenditure 2009 10to2014 - 15

Source :Autumn Statement 2011 |

1.6 The Government's deficit reduction strategy has a greater impact on departmental spending than these overall totals suggest because it:

● will reduce administration budgets (spending on running departments, excluding front‑line activities) by a third by 2014‑15; and

● includes additional policy commitments announced since the June 2010 budget and unavoidable cost pressures, for example, additional interest payments on the national debt.

1.7 In the 2011 Autumn Statement, the Treasury estimated that Total Managed Expenditure in 2014‑15, as shown in Figure 2, will be over £77 billion3 lower in cash terms than if:

● Departmental Expenditure Limits had grown in line with inflation; and

● the policy changes in welfare spending and other Annually Managed Expenditure announced by the June 2010 and 2011 Budgets, and the Autumn Statement had not been implemented.

1.8 Unlike previous cost reduction programmes, there are no centrally monitored efficiency targets covering the current Spending Review period. The head of the Efficiency and Reform Group told the Public Accounts Committee that around half the spending reductions should represent efficiency savings across the public sector, rather than cuts to services. However, there is no formal target and no central guidance on how such improvements can be calculated or reconciled against spending plans.

__________________________________________________________

1 Further details can be found in the Comptroller and Auditor General's report Cabinet Office: The Efficiency and Reform Group's role in improving public sector value for money, Session 2010-11, HC 887, National Audit Office, March 2011.

2 Office for Budget Responsibility, Economic and fiscal outlook, November 2011, paragraph 1.10.

3 Of this total, £49 billion represents the reduction in spending covered by Departmental Expenditure Limits assumed in the March 2010 budget, and confirmed by the Coalition, and £28 billion represents additional reductions introduced since the 2010 election. This is some £6 billion less overall than the projection in June 2010 (paragraph 1.1) owing to updated economic projections.