4. Market stage: Developed vs. undeveloped

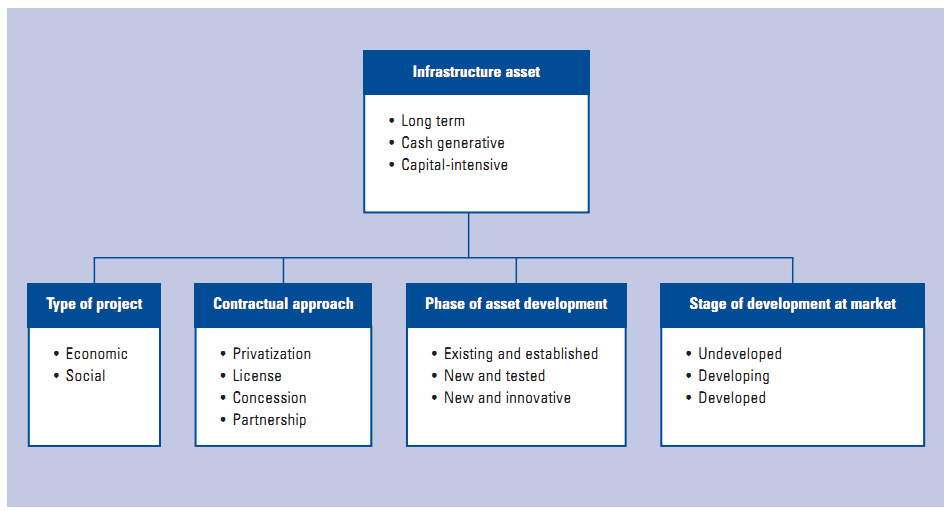

Private financiers are no different from other investors in that they will always consider the risk-reward tradeoff of any opportunity. Part of the risk-reward equation will be how developed the market is for the transaction. This will take into account many factors, including the technology required, the revenue sources, and the approach and type of project. But the outcomes can often be very country-specific. For example, the public-private partnership approach is mature and developed in countries such as the United Kingdom and Australia. However, this approach is still in its formative stages in the United States. Figure 1 summarizes the four elements of dynamic infrastructure opportunities: type, approach, phase, and market.

Figure 1: Parameters for defining infrastructure

Overall, the definition of an individual infrastructure opportunity needs to draw on all four components in order to give a meaningful description. For example, a partnership for a new social infrastructure project in a developed market is very different from the privatization of an established economic project in an undeveloped market. These differences will attract or deter different sources of private finance.

It is worth noting that, within these general descriptions, the market has created a whole variety of subcategories. The creation of subcategories is most prevalent when seeking to describe the contractual approaches: for example, the role of the private sector in concession-type contracts can vary significantly depending on factors such as whether the concessionaires themselves are responsible for the design, operation, or finance of the project. Appendix A.5 has a more detailed description of the variety of contractual approaches and associated acronyms.