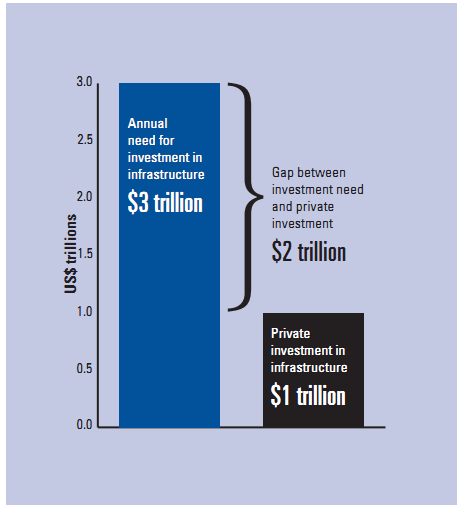

Private finance can help bridge an estimated US$2 trillion per annum financing gap

Having identified the annual investment need to be around 5 percent of global GDP, or US$3 trillion (which is significantly above historical levels of spending in many countries), the expectation is that governments will not be able to fund all infrastructure from the public purse without a fundamental shift in budget priorities and/or an increase in taxation. So there is a gap between funds available and funds needed-what we refer to as the financing gap. As it seems unlikely that governments are going to be able to, or indeed want to, fund their investment need in infrastructure alone, the question is: What role can private finance play?

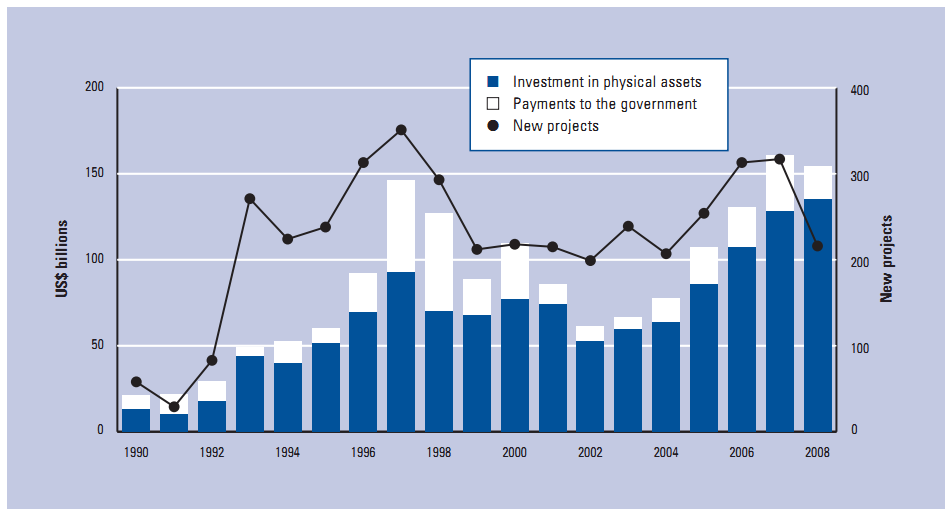

Private finance is not new to infrastructure investment; it has a long history of contributing to help bridge this financing gap. The World Bank's Public Private Infrastructure Advisory Facility estimates that private participation in infrastructure in low- and middle-income countries has averaged 1 percent of national GDP since 2003.7 Figure 4 illustrates trends in private infrastructure investment in developing countries from 1990 to 2008.

In many developed economies, private finance has been making an increasingly significant contribution to infrastructure development, in particular social infrastructure, through public-private partnership (PPP)-type transactions. For example, in the United Kingdom- which has one of the most highly developed PPP pro-grams-the government estimates that over UK£100 billion in private-sector investment has been made in infrastructure in the last 10 years.8 To put this into context, private-sector investment in social infrastructure PPPs represents 10 to 15 percent of the United Kingdom's total investment in public services in 2005 - 06. 9

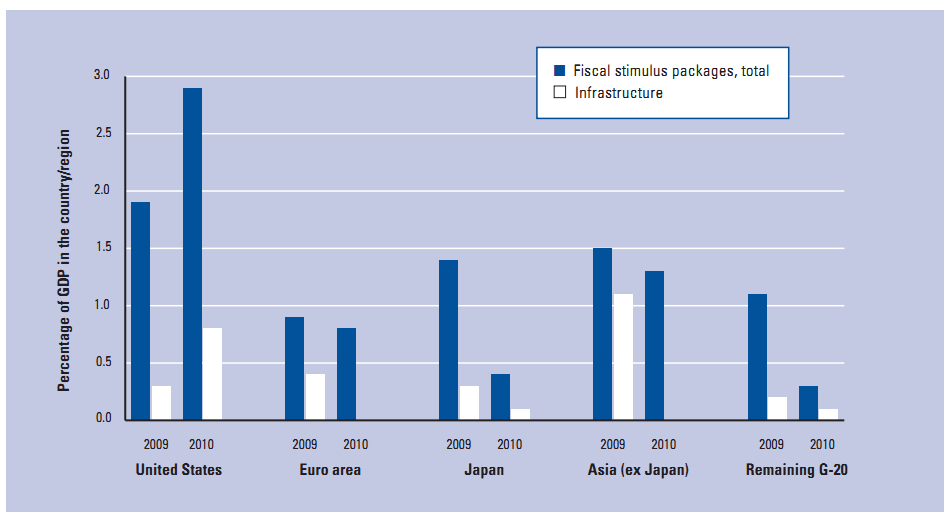

Figure 3: Budget allocations for infrastructure projects, 2009-10

Source: IMF, 2009.

Figure 4: Investment commitments to infrastructure projects with private participation in developing countries, by investment type (1990-2008)

Source: World Bank, 2008, slide 7.

Figure 5: Gap between need and private investment in infrastructure

Overall, an estimate made by Ernst & Young in 2007 suggested that global private investment in infrastructure was around US$1 trillion.10

If it is estimated that investment need is around US$3 trillion per annum globally, and private investment in infrastructure is around US$1 trillion, then the financing gap is in the region of US$2 trillion per annum if private investment remains constant. This is illustrated in Figure 5.

By providing a factual description of the private finance markets (for more information, see Appendix A), this Report seeks to provide some context to the debate about what the future may hold for infrastructure finance in filling this financing gap. Through a dialogue with a number of parties closely involved with infrastructure (such as procurers, enablers, and providers of private finance), we also articulate some of the challenges and opportunities to maximize the role of private finance in the future.