4. Bankruptcy regime and ultimate ownership

In the context of the bankruptcy regime, ultimate ownership is about what happens on failure of a privately owned/operated asset. For example, is the government's preference to find a new private-sector owner/operator through a trade sale, or is the desire to have contractual provisions that take it back into public-sector ownership?

One important factor connected with ultimate ownership is that of "step-in rights." In many circumstances, the debt providers will want to retain a right, but not an obligation, to attempt to restore or work out a failed project by stepping into the rights and responsibilities of the private-sector entity. This can happen only in limited circumstances, such as the bankruptcy of the private-sector entity; when step-in rights are invoked, the equity investors and shareholders are no longer party to the transaction.

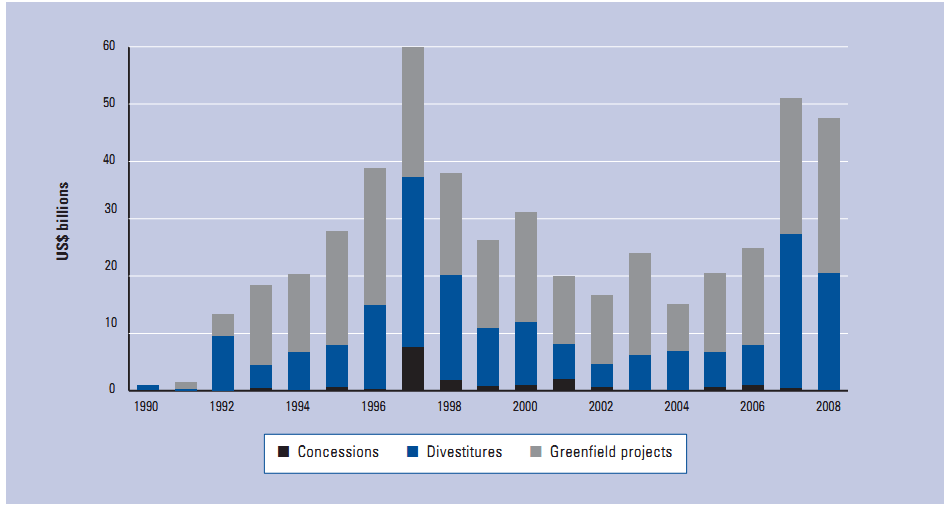

Figure 2: Investment commitments to energy projects with private participation in developing countries, by type of public and private involvement (1990-2008)

Source: World Bank and PPIAF, 2008, slide 16.

Public-sector parties concerned about continuity of service delivery may want to have the ability to maintain the contracts and arrangements the private-sector party has established with some project parties should the private-sector entity fail for some reason.