Assessments of private-sector approaches must consider full life-cycle costs and the expected costs of risks

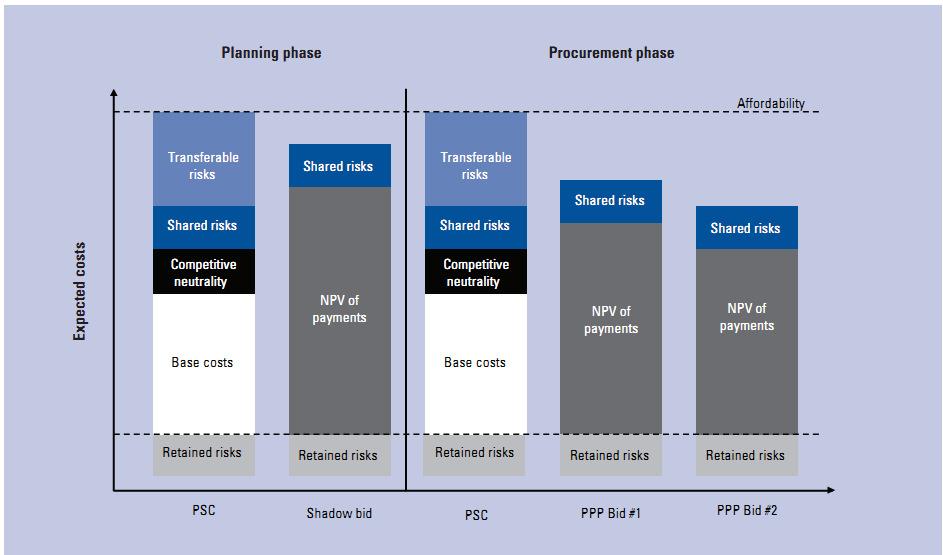

Much of the public's concern about private finance stems from the belief that private finance involvement inherently costs more. This perception is likely to be true if the financing costs are considered apart from other contract terms such as construction effectiveness, operational efficiency, and risk transfer. After all, most governments can fund themselves more cheaply than commercial enterprises can. However, this assumption does not factor in the expected cost of the whole contract delivery, including risk transfer. In order to make an informed comparison of the cost of public and private solutions, a comparative analysis (often called a value-for-money analysis) needs to be completed, which takes into account all of the costs and the risk transfer. Figure 1 provides a summary of how this analysis is developed for both the planning and procurement phases of a project.

Figure 1: Illustrative comparative analysis of public and private funding solutions

Source: PricewaterhouseCoopers, unpublished document, 2010.

Note: PSC is the "Public Sector Comparator" or the public sector cost of delivering a proposed contract . The shadow bid is an estimate of what PPP bids will be.

In this analysis, five elements are identified as making up the public-sector cost of delivering the proposed contract (the public-sector comparator or PSC):

∙ Retained risks: The expected cost of risks retained by the public sector.

∙ Base costs: The expected capital and operational expenditure needed to build and operate the infrastructure.

∙ Competitive neutrality: An estimation of the cost savings of competitive bidding processes.

∙ Shared risks: The expected cost of risks shared between the public and private parties.

∙ Transferable risks: The expected cost of risk transferred to the private sector.

Alongside this analysis, the public sector will need to decide what it can afford. If the PSC is above what it can afford, then consideration will need to be given to whether reducing the transferable risk and increasing the retained risk is possible, or if the benefit of competition has been underestimated.

Education and transparency about all costs and rewards associated with different financing options are critical to assessing those options on a truly comparable basis. It is essential to present clear and comparable information to enable the public to reach a balanced judgment.