The capital and liquidity constraints of banks has led to reduced capacity, shortened terms, and increased costs

In many respects, what has happened in the past 18 months has been a retrenchment by banks from long-term, very cheap lending that characterized the preceding few years. This retrenchment has been driven by liquidity and/or capital constraints, leading to increased pricing, shortened terms, and overall reduced lending capacity.

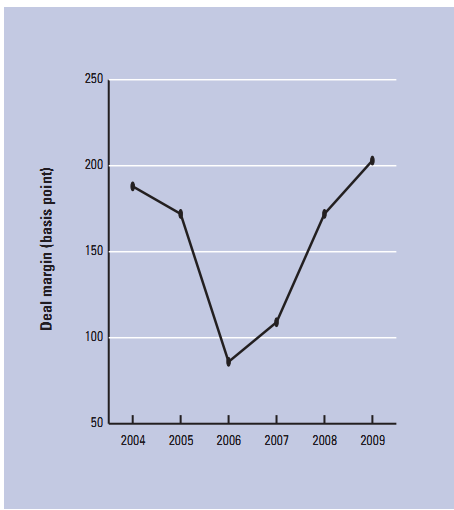

For example, globally, deal margins in the PPP sector have more than doubled in the period 2006 to 2009 (see Figure 4). The reduction in loan term has not been entirely consistent across the banking community, but a survey of 20 of the leading banks in the UK PPP market completed in early 2009 reported "a consistent desire for a shortening of loan maturities."2

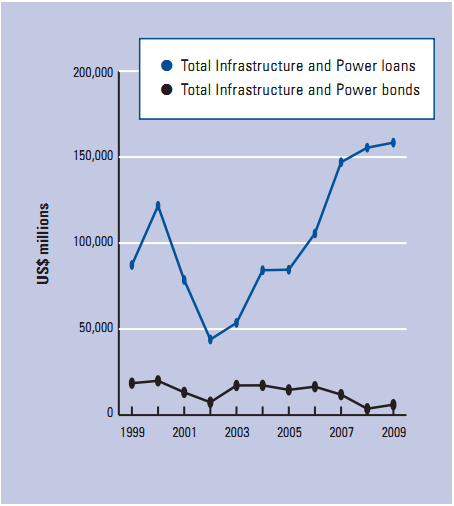

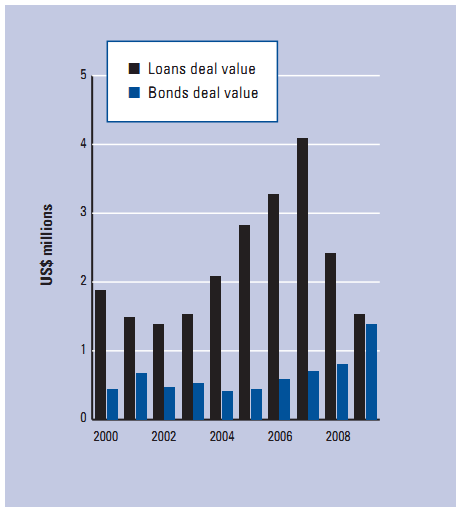

Figure 1: Infrastructure and Power: Global loans and bonds, 1999-2009

Source: Dealogic (accessed March 4, 2010).

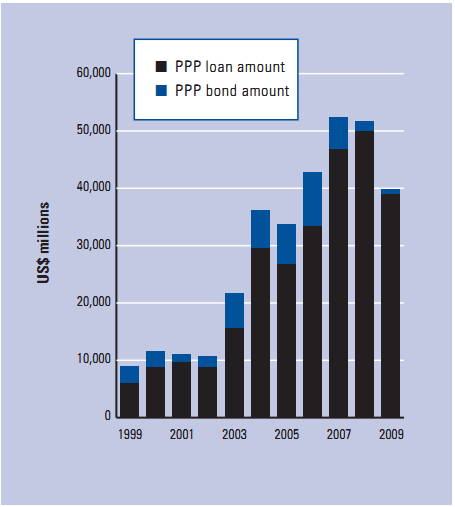

Figure 2: Total global infrastructure: PPP loans and bonds, 1999-2009

Source: Dealogic (accessed February 3, 2010).

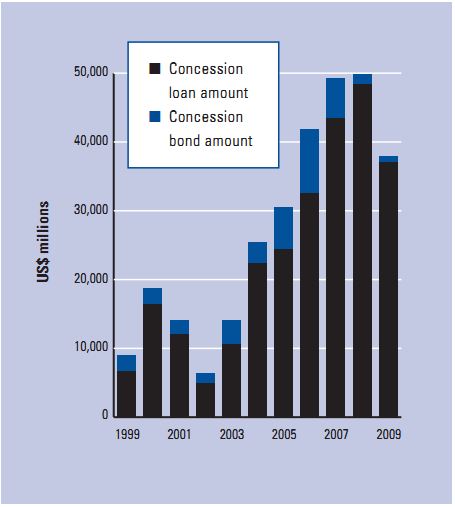

Figure 3: Total global infrastructure: Concession loans and bonds, 1999-2009

Source: Dealogic (accessed February 3, 2010).

Note: It should be noted that the totals for PPPs and concessions do not tally directly to the global amounts because some authorities record transactions as both a PPP and a concession.

Figure 4: Deal margins for PPP transactions

Source: Dealogic (accessed November 3, 2009).

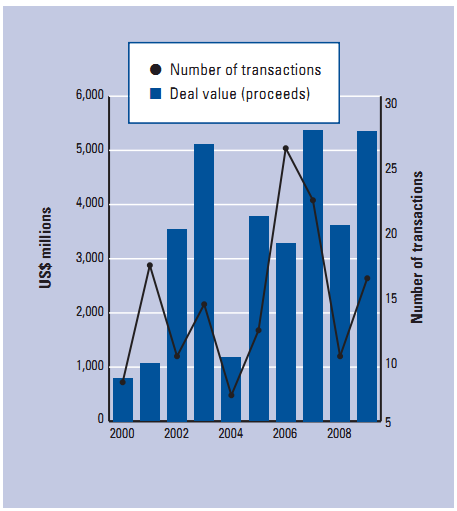

Figure 5: Corporate bonds and loans, 2000-09

Source: Dealogic (accessed February 1, 2010).

Figure 6: Bond issuance in the UK water utility sector

Source: Dealogic (accessed November 3, 2009).

"Banks are best suited to financing - Nick Pitts-Tucker, Former General Manager, Co-Head of Corporate |