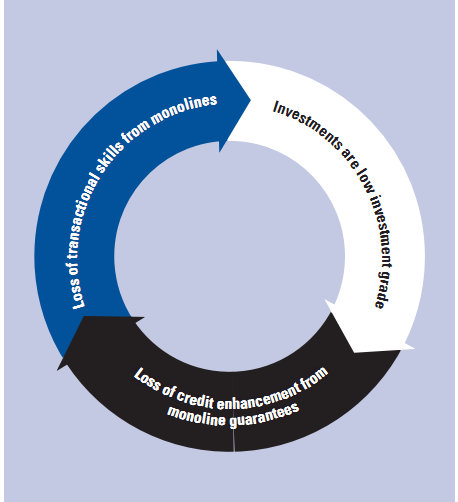

The infrastructure bond market must overcome a vicious cycle of declining investment grade projects and loss of credit enhancement and transactional skills from the monoline insurers

Much of the infrastructure bond market, particular for the PPP and concessions sectors is of low investment grade. This is steadily exacerbated as credit enhancement through monolines has fallen away together with the transactional skills those monolines bring to the market. This "vicious circle" is illustrated in Figure 7.

By contrast, the regulated asset base that underpins the UK water utility bond issuance helps to secure a better underlying credit rating, between BBB- and A. We have identified three challenges that need to be overcome to reinvigorate capital market interest in infrastructure projects in developed and emerging economies. These are summarized in Table 1. In emerging economies, the list of challenges will grow to include elements such as political instability, uncertain regulatory regime, and undeveloped domestic corporate markets. Each of these factors will demand their own responses.

Table 1: Challenges limiting capital markets interest in infrastructure projects

Challenge | Possible response |

Underlying opportunities are low investment grade | Obtain a guarantee from monoline insurer. Change the risk-reward profile to increase the rating. As part of this change, the financial structure may need to reduce the senior debt leverage, possibly by introducing "first loss" or subordinated bonds. |

Loss of credit enhancement from monoline guarantees | Encourage the re-emergence of the monoline insurers. Create state-supported substitutes for monoline insurers. |

Loss of transaction skills from monolines | Build transaction skills in arranging banks or a body substituting for monolines. |

Figure 7: Vicious circle in the infrastructure bond sector

Source: World Economic Forum analysis

Substitute or recreate the monoline role

A recurring question is whether to reconstitute the role of monoline insurers, including their transactional skills. There appear to be no moves to try and recreate mono-line bodies. Those monolines that survived the financial crisis will no doubt rebuild their balance sheets and consider if and how they will re-engage in the infrastructure market.

Now there is greater focus on revising project financial structures with the incorporation of "first loss" or subordinated bonds. The goal behind this restructuring is to reduce the risk to the senior debt tranche, as illustrated in Figure 8.

In this model, the amount of senior bonds required has been reduced and the gap has been filled by subordinated bonds. The senior bonds would continue to be issued to institutional investors, but the subordinated bonds would be acquired by specialist investors and would attract a higher yield than the senior bonds. If there are any shortfalls in the project financing, these subordinated bonds would be adversely impacted before the senior bonds. By creating this first-loss position, the rating of the unwrapped senior bonds is anticipated to improve.