Prevalence of general funds

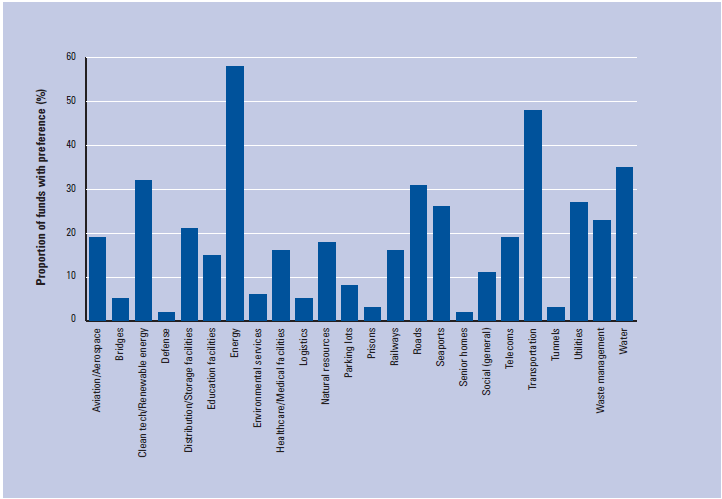

Recent reviews of infrastructure funds have concluded that the majority are targeting a range of different sec-tors,3 as illustrated in Figure 1. The fact that many funds are allocating capital to energy, transport, water, roads, and renewable energy suggests that these are the sectors offering the most investment opportunities. They are also the sectors that provide assets that best fit the long-term stable profile that many investors desire.

It would seem that many funds are also targeting both new and existing transaction opportunities (although there are limited data here). This might stem partly from different views on what really differentiates greenfield and brownfield opportunities (as discussed in Chapter 1.1).

Many funds are generalists and do not distinguish between concession contracts and privatizations. One exception is public-private partnerships (PPP), where funds have been developed to focus solely on these types of transactions. Another area is investment in clean energy infrastructure, where a number of specialized funds exist.

Many fund managers do specialize around geographies, such as North America, Asia, or Europe.

Figure 1: Infrastructure investment preferences

Source: Preqin, 2009.