Geographic mismatch between pension funds and infrastructure opportunities

Money held in pension funds is not always located where the investment is needed. For example, 64 percent of pension funds worldwide are held in the United

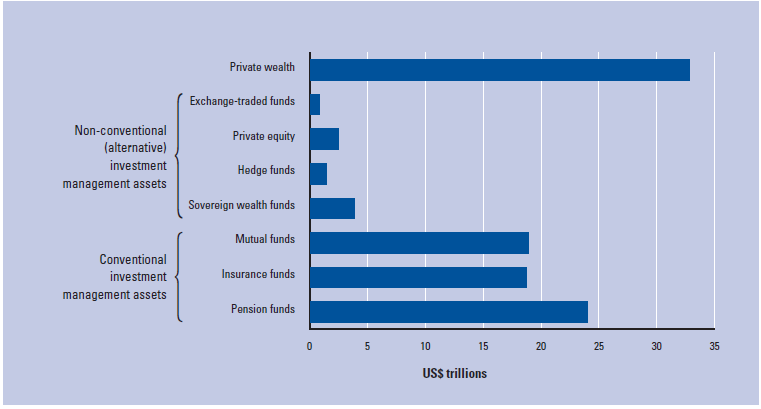

Figure 1: Assets under management, 2008

Source: IFSL, 2009.

States and only 16 percent are held in countries outside of the United States, Japan, and a handful of Western European countries, as seen in Figure 2.

Furthermore, recent surveys by Watson Wyatt,3 reviewing the US$872 billion alternative assets under management used by the top 100 asset managers on behalf of pension funds,4 indicated that over 50 percent of their infrastructure investment was in Europe (Table 1). There seems to be a bias towards investment in Europe, potentially at the expense of other geographies that have a greater need for infrastructure investment. Europe offers a relatively stable political environment, a largely homogenous legal and economic environment, and has generally embraced the involvement of private finance in infrastructure.

Table 1: Infrastructure investment by region

Region | Amount invested in infrastructure in region |

Europe | 54% |

North America | 30% |

Asia Pacific | 15% |

Other | 1% |

Source: Watson Wyatt, 2009a, 2009b.

It is surprising that the amount invested in infrastructure by these top 100 managers is not greater. The survey found in 2008 that only 9 percent of the alternative assets were invested in infrastructure (Table 2).

Table 2: Investments in alternative asset classes

Subdivision of alternative asset class | Percent invested |

Real estate | 58% |

Private equity fund of funds | 20% |

Fund of hedge funds | 13% |

Infrastructure | 9% |

Commodities | negligible |

Source: Watson Wyatt, 2009a, 2009b.

So what seems to be holding back greater investment by pension funds?