The role of pension trustees and their advisors

An important factor that is little discussed is the role of the pension trustees and their advisors. The trustees work on behalf of the pension fund beneficiaries to oversee the fund's investment strategy and implementation. Despite this important role, many trustees are not necessarily investment experts, and a number may well be employees of the entity that has its pensions in the fund. This can have two consequences. First, the trustees are very reliant on their investment advisors and second, they have a natural inclination to stick with more traditional, easy-to-understand investment assets such as government bonds or equities. If they are to diversify into the alternative asset class, then they will be reliant on their investment advisors to explain to them the risks and rewards of an infrastructure opportunity. While there are a number of such advisors who have built up their infrastructure knowledge, there are undoubtedly a large number, often in the smaller advisory practices, who have not. Thus the relative lack of interest in and/or knowledge of the sector by these advisors becomes an impediment to pensions making the move to invest in infrastructure opportunities.

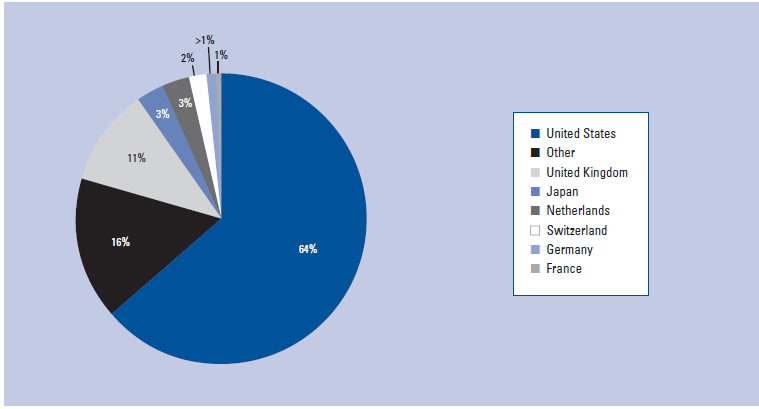

Figure 2: Proportional share of sources of pension fund assets at end of 2008