FINANCIAL OVERVIEW

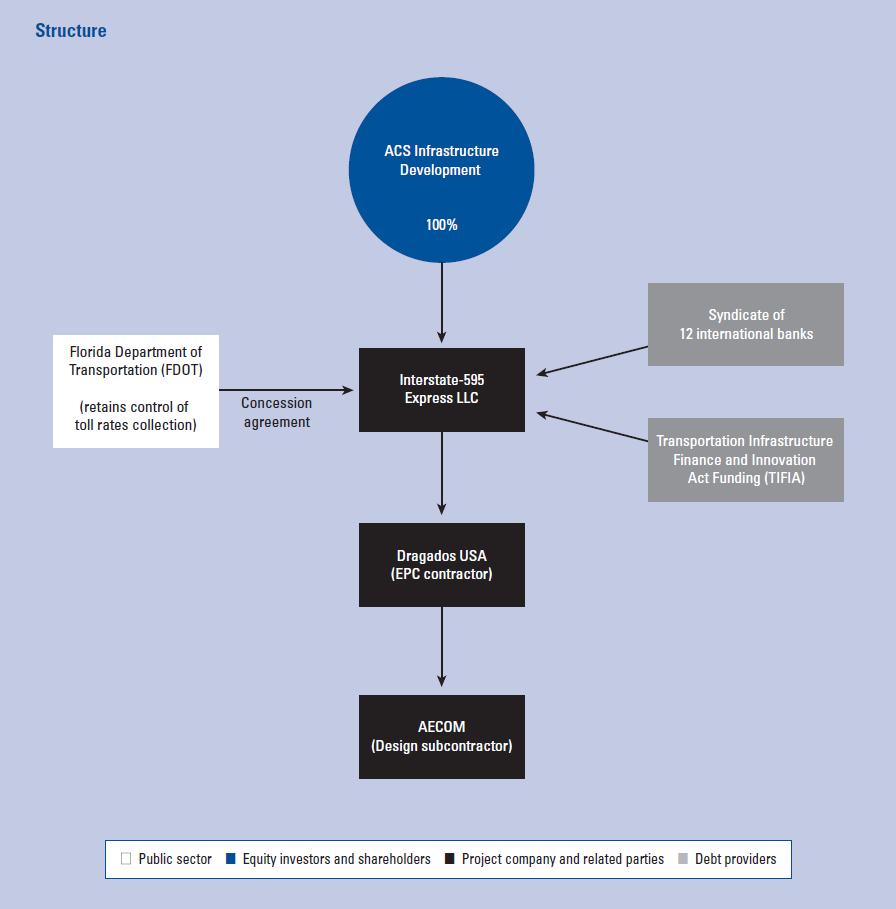

The financing structure for the project was a combination of commercial debt and a loan. Originally, it was anticipated that much of the funding would come through issues of private activity bonds (PABs). To encourage this, FDOT obtained approval from US DOT for a provisional allocation of US$2 billion. Nonetheless, private financing was all arranged in the senior debt bank market, with the balance provided by a TIFIA loan.

Source of funding | Amount | Percentage |

Concessionaire equity | US$290 million | 17% |

Senior bank debt | Tier 1: US$525 million | 47% |

| Tier 2: US$256 million |

|

TIFIA loan | US$603 million | 36% |

TOTAL | US$1,674 million | 100% |

Senior bank debt was split into two tranches of short-term debt, one with a term of 9.5 years and the other with a term of 10 years.