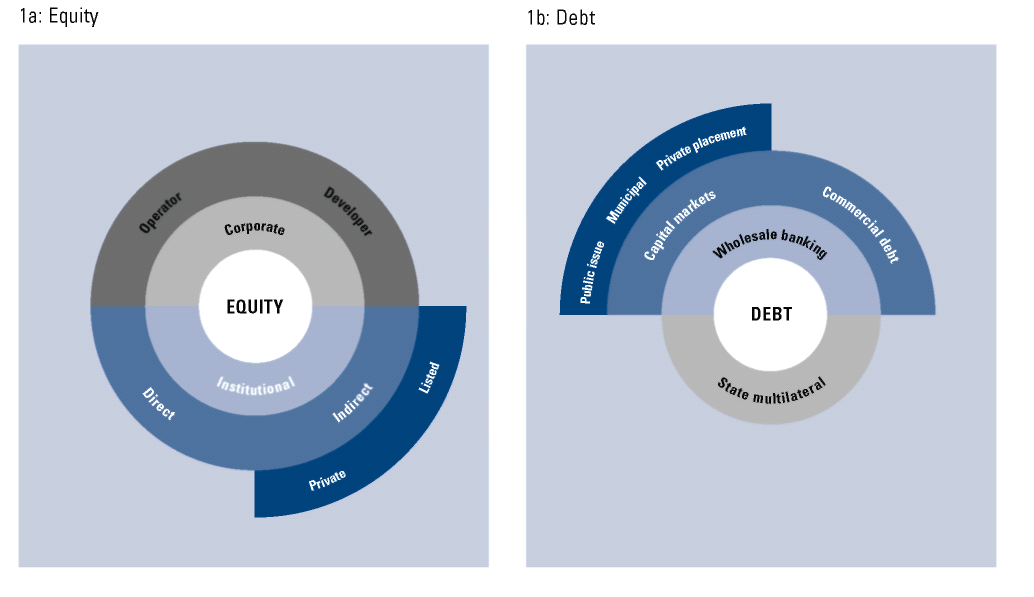

There are many different sources of debt and equity and different routes to market for investors

Using the term private finance can gloss over the fact that there are many different types of equity and debt private finance that might be lent or invested in infrastructure. The next chapter will describe each of these sources in more detail. Figure 1 is a high-level summary of the sources.

Table 1 seeks to describe the different routes available to different classes of investors who are interested in investing in infrastructure. For example, some private pension funds invest in both the equity and debt elements of infrastructure projects by buying bonds or investing in infrastructure funds. There is also evidence that some pension funds are now investing directly in assets and enterprises.1

Table 1: Routes available for investment in infrastructure

| Debt | Equity | ||||

Investor type | Public capital mkts | Muni bond mkts | Private placement | Direct | Listed fund | Private fund |

Corporations | • | • |

| • |

|

|

High net worth individuals | • | • |

|

| • | • |

Insurers | • | • | • |

| • | • |

Private pension funds | • | • | • |

| • | • |

Public bodies | • |

|

|

|

| • |

Public pension funds | • | • | • |

| • | • |

Note: | ||||||

Figure 1: Sources of debt and equity

Before surveying the sources of private finance in detail in later chapters, we review here the main principles that underpin the capital and contractual structures used for infrastructure projects. This introduction will describe:

• what a typical capital structure might be, including a brief commentary on the theory of what drives that structure;

• the dynamics of a typical asset or enterprise cash flow and priority of payments; and

• what a transaction contractual structure may look like for the four approaches we have identified- that is, partnership, concession, privatization, and licensing arrangement.