Any assessment of an infrastructure opportunity will include an analysis of the sources and uses of cash over the whole investment period

A focus on cash flows and the ability of the infrastructure asset or enterprise to generate cash are two key elements that define the infrastructure investment proposition. The cash can come in many forms, but in every case there is a link between the availability/performance of the infrastructure and the receipt of the funds. Examples of sources of cash are:

• individual user-based payments-for example, tolls or "fare box" payments and utility charges;

• access charges-such as those for airports, ports, and railways;

• public authority payments-for example, shadow tolls, grants and/or subsidies; and

• off-take fees-such as those for power generation.

Often these payments are regulated, so there is a limit on their amount.

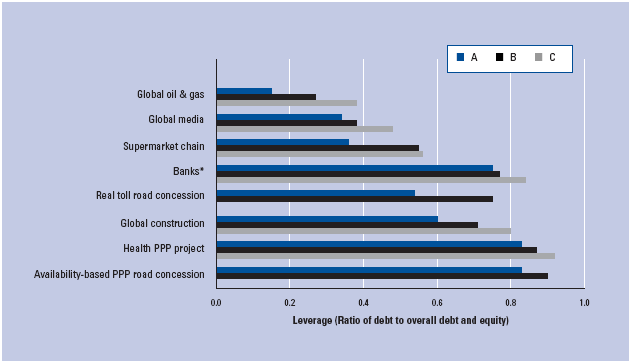

Figure 3: Leverage across a variety of industry and infrastructure sectors

* All three banks are based in the same country.

This focus on cash flow means that any analysis of an infrastructure investment proposition will consider three elements:

• revenue,

• operating costs (and capital costs if applicable), and

• debt costs.

Further, if the asset is operated under a concession contract (i.e. under a finite operation period), debt may not be available for parts of the concession period. So, once the debt is repaid, the free cash flow will be revenue less operating costs only, i.e.

free cash flow = revenue less debt service less operating costs

Given that infrastructure is a long-term proposition, potential private finance investors and lenders will focus on the predictability of each of the elements of free cash flow and how those elements might change over time or due to circumstances. This analysis will help to define not only the capital structure but also some of the approaches to contract.

Although we highlighted some of the challenges of forecasting revenue and operating costs in Chapter 1.3, it is worth mentioning here that private financiers will not look at the different cash flow elements in isolation. Rather it is the relationship between them that is important. For example, if the revenue stream is subject to variation such as seasonality or is linked to GDP in some way, then private investors will prefer the operating costs to also be variable so that they can flex those costs to reflect seasonal adjustments or the impact of GDP. A proposition that has variable revenue but a high proportion of fixed operating costs is vulnerable in revenue downturns (since the free cash flow will decrease, or even become negative). More equity (or less leverage) may be needed to provide some cushion for times when revenue is constrained.