There are many ways public and private parties may organize themselves

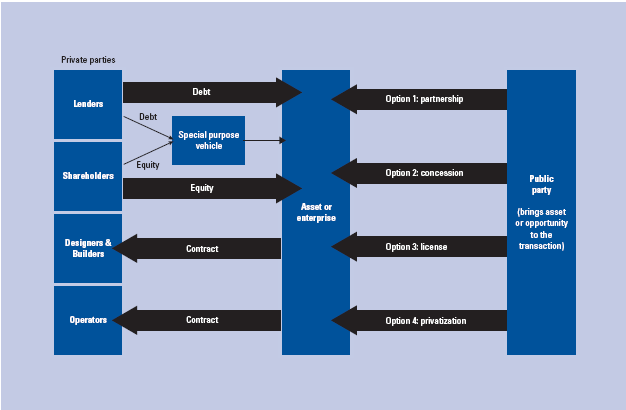

There is no fixed way the public- and private-sector parties organize themselves and contribute to an opportunity, but there are some framing principles. Figure 5 provides a high-level summary of how the public and private parties might come together for an infrastructure project.

On the private-sector side, the shareholder(s) may channel their investment into a special company whose sole purpose would be to develop or operate the infrastructure. Or the asset/enterprise may be a subsidiary of their existing business.

The subsidiary route is really only a possibility if there is a single shareholder and limited debt requirements that can be provided under more general corporate facilities. If there are multiple shareholders and significant debt requirements, then there is usually a desire to ring-fence the debt and equity to the individual asset/infrastructure-hence the common use of the special company.

Also on the private-sector side, there may well be ancillary subcontracts to build an asset and/or provide services. But there are also many examples of the employees or services being provided by the asset company.

On the public-sector side, four main contracting options are described at the right side of Figure 5. In each of these cases the public sector will bring to the transaction either an existing infrastructure asset or an opportunity to develop one. In the case of a partnership, they will also contribute some equity to the enterprise. There may also be some regulatory framework associated with the contractual arrangement, in particular where the approach is to privatize or license the infrastructure.

Figure 5: Illustration of how public and private parties may collaborate for an infrastructure project

TAKE-AWAYS | |

Capital structure • The amount of debt and equity invested in an enterprise is not random but is a combination of the risk of an individual opportunity/project and that of competing investment opportunities, along with the impact of market imperfections such as tax policy and cost of bankruptcy. | Priority of payments • Priority of payments is no different from other corporate opportunities, but may include some additional mechanisms to protect the debt stake. |

• Understanding the likely leverage will help determine both the cost and the amount of debt and equity needed to fund an opportunity. • Some infrastructure financing is based on highly leveraged transactions. | Contractual structure • There is no fixed contractual approach, but most will be a variant of public and private options for collaboration (see Figure 5). |

Cash flow • Infrastructure is a cash-driven market. • Private financiers' analysis of a potential opportunity will focus on the relationship between revenue and costs. |

|