Institutional equity comes from a diverse range of sources and invests in a wide range of infrastructure

For the purposes of this Report, the term institutional equity refers to the capital raised from institutional investors and, very occasionally, from some high net worth individuals. Figure 2 illustrates this diversity of investors in infrastructure funds.

A lot of institutional equity has been committed to or invested in infrastructure funds, although there are also examples of institutional equity investing directly in assets. For example, in the United Kingdom, lending banks such as the Royal Bank of Scotland and Barclays invested equity in the United Kingdom's Private

Table 1: Development of Ferrovial in Spain

Years | Action |

1950s | Founded as a construction company with a focus on major infrastructure projects in Spain-for example, railway building. |

1960s | Expands business outside Spain but with a continued focus on major infrastructure. At the end of the decade, the company starts to expand into real estate development and invests in its first road concession in Spain. |

1970s | Continues to expand the construction business by geography and sectors. Invests in a second road concession in Spain. |

1980s | Invests in a third road concession in Spain. Constructs many projects linked to the 1992 Barcelona Olympics. |

1990s | Restructures to create a separate construction company (Ferrovial Agroman) and concession company (Cintra). Invests in its first airport concession and telephone operator; develops asset operational activities, including waste and facilities management. |

2000 to present | Continues investment in concessions; acquires Amey, a company active in the United Kingdom's social infrastructure market; and BAA, the management company operating seven UK airports, including London Heathrow. Invests in infrastructure including the Chicago Skyway project, the Canadian ETR 407 road, and the Indiana toll road. In October 2009, Cintra merged with Ferrovial. |

Source: World Economic Forum interpretation of information from Grupo Ferrovial History, available at http://www.ferrovial.com/en/index.asp? MP=14&MS=241&MN=2.

Note: The Infrastructure/concessions business contributes approximately 70 percent of either the group's earnings before interest and tax or the balance sheet assets profit in the year ending December 2008.

Figure 2: Infrastructure investors by firm type

Source: Prequin, 2009.

Note: The figure shows number of institutions investing in infrastructure (rather than the amounts invested).

Finance Initiative (PFI) projects. Further, there is increasing evidence that other sources of institutional equity-for example, some pension funds and sovereign wealth funds-are also looking to invest directly in infrastructure projects. It is notable that the skills, risk, and aims for these types of investment are different from those of the fund route.

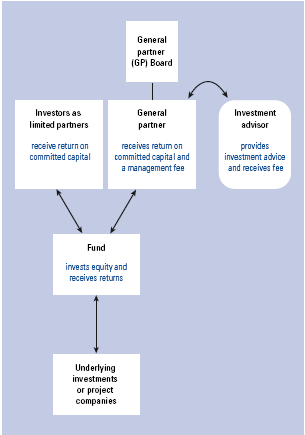

If the route to direct investment is through an intermediary fund, then funds can either be listed (i.e., publicly traded on stock exchanges) or unlisted (equity that is not publicly traded). Many funds are based on a limited partnership model (see Figure 3).

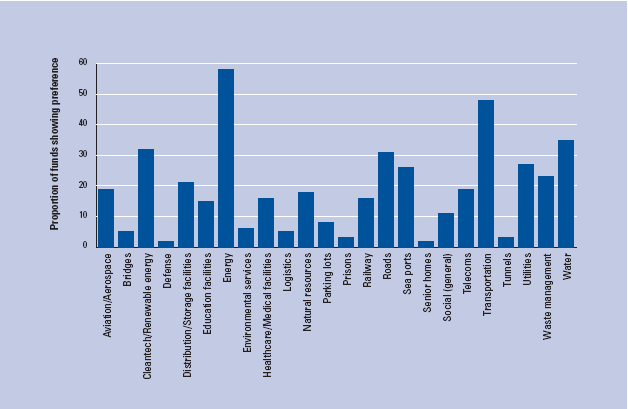

When funds are being raised, the fund sponsor will describe the planned scope of the fund. For example, some funds-such as an airports fund or an established-project-only fund-are focused on a particular sector, geographic area, or asset. Others have a more general approach and seek investment opportunities that meet the characteristics of the broader definition of infrastructure outlined in Chapter 1.1. This definition considers infrastructure to be a group of capital-intensive projects that develop and operate tangible assets with the purpose of generating a long-term cash flow. The diversity of infrastructure investments is significant, although those in energy, transport, water, and renewables seem to be the most sought after, as illustrated in Figure 4.

Figure 3: Limited partnership model

Source: World Economic Forum analysis.

Figure 4: Infrastructure fundraising by asset type preferences: January 2007-June 2009

Source: Preqin, 2009.