Infrastructure may provide portfolio diversification for investors and returns that match liabilities

Although we are dedicating an entire report to the topic, infrastructure finance is a very small part of the broader financial market. So what does it offer institutional investors? As described in Chapter 1.1, infrastructure opportunities offer long-term, often highly predictable or stable returns. Thus infrastructure finance is attractive to institutional investors because it can offer:

• sector- and time-horizon diversification within their portfolios, and/or

• returns suitable for their risk profile.

The extent of portfolio diversification that infrastructure investment can offer is open to challenge and will depend on its type. For example, the performance and investment returns of some types of infrastructure- such as airport and ports-can be closely correlated to national economic performance.

The risk profile of infrastructure is particularly pertinent to pension funds. Infrastructure offers pension funds an alternative to government bonds or treasuries, by providing one of the few other opportunities for long-term investing.

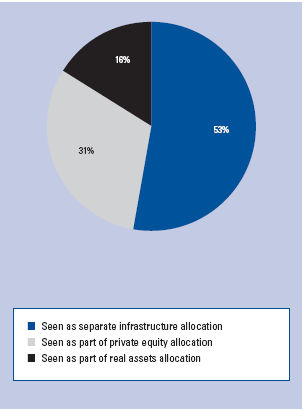

Figure 5: Distribution of infrastructure investors by source of infrastructure allocation

Source: Preqin, 2009.

Note: The split is determined by number of investors sampled.