The money available to invest in infrastructure has increased significantly in recent years, but investors differ in how they classify investments

Until recently, an institutional investor's allocation of equity to infrastructure was part of its allocation to alternative investment markets. This often fell within the allocation for real estate within the alternative investment category. Consequently, infrastructure was a niche within a niche. This meant that little, if any, available investment went to infrastructure. But this has changed in recent years, and for an increasing number of institutional investors infrastructure now has its own allocation within their portfolio. The proportion of allocations is illustrated in Figure 5.

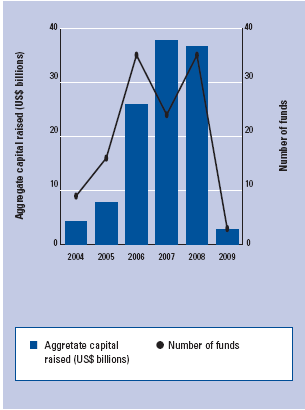

The growth in infrastructure funds is illustrated by Figure 6, which shows that over the past five years from 2004 to 2008, an aggregate of US$115.2 billion was raised by 122 funds.

Although fund sizes vary greatly by geography, as shown in Figure 7, what is notable about this graph is the emergence of the mega fund, with more than US$1 billion to invest. The mega fund phenomenon began in the United States in 2006 and followed into Europe.

Despite the global economic crisis in 2008-09, fundraising has continued. For example, in October 2009, Actis, a global private equity fund focused on emerging markets, closed a US$750 million fund-raising for investment in infrastructure across emerging markets.1 While funds raised in 2009 are significantly less than those raised in 2008, the number of funds seeking investors has actually increased in 2009 compared to 2008-see Figure 8.

Figure 6: Infrastructure fundraising, 2004-09 (first half)

Source: Based on data from Preqin, 2009.

It is startling is that over 70 percent of these funds are being launched by first-time infrastructure fund managers, as shown in Figure 9. This figure is probably an indication that, although private finance has been investing in infrastructure for many years, the emergence of institutional equity is relatively new and still undergoing growing pains.