The listed vs. unlisted fund approach

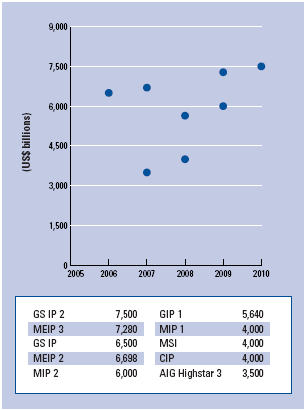

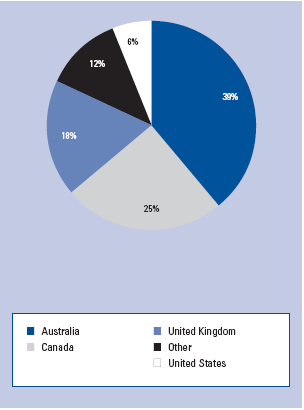

The majority of specialized infrastructure funds, including all those in the top 10, are unlisted (see Figure 10). Debate continues on the advantages and disadvantages, briefly summarized in Table 2, of each approach. The emergence of listed funds has been focused in only a few countries: 88 percent of listed funds in 2009 were managed out of Australia, Canada, the United Kingdom, or the United States, as seen in Figure 11.

It is worth noting that the impact of the credit crunch has been markedly different for listed and unlisted funds. The unlisted funds have largely continued activity as before, although they have had to deal with the consequential impact on their underlying investments. The listed funds, however, have had to deal with the twin effects of their general fall in share prices (given their correlation to stock market performance) and, where the fund is corporate-sponsored, the issue of any particular pressure on that company's share price. This is illustrated in Figure 12, which compares the performance of Australian listed infrastructure funds to the Australian Securities Exchange (ASX). Since the crash in 2008, some infrastructure shares have recovered to track the ASX, but others remain well below this level. There is some speculation that the collapse of the Australian investment and advisory company Babcock & Brown and the difficulties faced by some the other listed funds in Australia in 2008 has cast a shadow on the listed fund model. There is also a question as to whether this is primarily an Australian market issue or a signal of a general move away from the listed approach.

Figure 10: Ten largest infrastructure funds, March 2009

Note: Years refer to the year the fund was set up. Based on currency valuations in March, 2009; euro to US dollar exchange rate of 1.456. GS IP 2 = GS Infrastructure Partners II; MEIP 3= Macquarie European Infrastructure Partners III; GS IP = GS Infrastructure Partners; MEIP 2 = Macquarie European Infrastructure Partners II; MIP 2 = Macquarie Infrastructure Partners II' GIP 1 = Global Infrastructure Partners I; MIP 1 = Macquarie Infrastructure Partners I; MSI = Morgan Stanley Infrastructure; CIP = Citi Infrastructure Partners; AIG Highstar 3 = AIG Highstar Capital III.

Table 2: Summary of characteristics of listed and unlisted funds

Listed funds | Unlisted funds |

• Provide liquidity for investment as they are publicly traded | • Illiquid investment |

• May provide overall investment diversification | • Potential lack of diversification |

• Can give rise to value volatility as correlation to other asset classes as continuous mark-to-market | • Low correlation of performance to other asset classes |

• More accessible and quicker to access by investors | • Limited opportunities to enter the market |

Figure 11: Listed fund market by fund manager location, 2009

Source: Preqin, 2009.