Primary vs. secondary (follow-on) funds

As is indicated above, many established infrastructure funds have a relatively short life, at circa 10 years, compared to the potential asset life or contract/concession period of the infrastructure that may be 25 or more years. At the end of the fund life, investors may opt to crystallize their investment and exit the fund or they may choose to invest in a follow-on or secondary fund. Because so many funds have been established in the last 3-5 years, there is little empirical evidence for what the trend might be, although to date those funds that have reached their terminal date have been rolled into a follow-on fund.

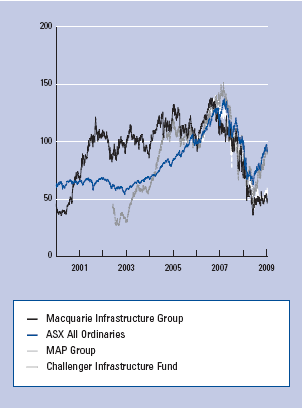

Figure 12: Performance of Australian listed infrastructure funds vs. the Australian stock market

Source: Thomson Reuters Datastream, available at http://extranet.datas-tream.com//LOGON.ASPX?URL=http://extranet.datastream.com/index.htm (accessed November 5, 2009).

Note: The raw data have been rebased to 100 on August 8, 2006, the listing date of the Challenger Infrastructure Fund.

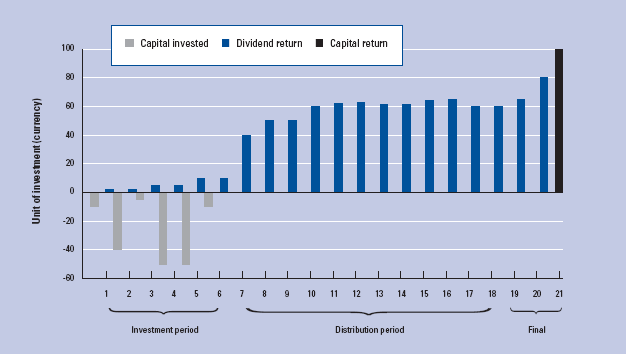

Figure 13: Simplified fund return profile

Source: World Economic Analysis, illustrative.

The term secondary fund can also be applied to funds where the original or primary fund focused on new projects with investors who take the risk of the development or construction of the project/asset. These investors are focused on a capital gain from an increase in value of the asset once it is fully operational, rather than on the long-term cash flow that the asset might generate. Once the projects or assets become fully operational, the risk profile changes and the return to investors is cash generated from the project. This change in project risk profile can therefore be an opportunity for the original fund to close and the assets to be acquired by a secondary fund, supported by investors attracted by the long-term yield.

Table 2: Overview of characteristics of seeded and unseeded funds

Seeded funds | Unseeded funds |

• The fund will have knowledge of the seeded part of portfolio and will have an actual performance to forecast. | • If the fund is being built up through acquisition of non-operational assets, there will be a lag between the investment date and any return on investment. |

• Assets may include revenue-generating investments, which means investors can get a day-1 return on their investment. | • There is a risk that appropriate assets will not be acquired and the fund will not invest its committed funds, which in turn means cash is held and the investors' commitment does not attain the yield forecast. |

• The fund management team has a demonstrable track record of investing and managing assets. | • There is a risk and cost to the bidding process. |

| • Unseeded funds have the ability to influence the transaction structure of investments. |

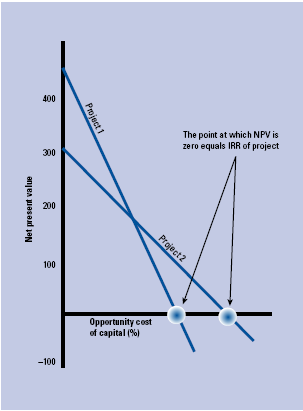

Figure 14: Net present value (NPV) vs. internal rate of return (IRR)

Source: World Economic Forum, based on Investopedia, available at http://www.investodedia.com/study-guide/cfa-exam/level-1/ corporate-finance/cfa11.asp.