The theory: How to measure return: Net present value vs. internal rate of return

When considering a new investment opportunity, investors need to be able to have some way to appraise the opportunity-to make the investment decision that will add value and not destroy it for them. The methodology used for this investment appraisal needs to be something that (1) can be applied consistently over time to measure how value changes and (2) allows meaningful comparison between opportunities. The choice is usually between an NPV and an IRR analysis (see Tables 3 and 4). The relationship between the NPV and IRR is shown in Figure 14.

Both of these approaches seek to value a series of cash flows that makes them appropriate for infrastructure opportunities that are all about generating cash from an asset. This analysis does not help to assess profit. Appreciating the principles of each approach is important because an NPV approach might suggest that one particular opportunity is better than another, whereas an IRR analysis might suggest otherwise.

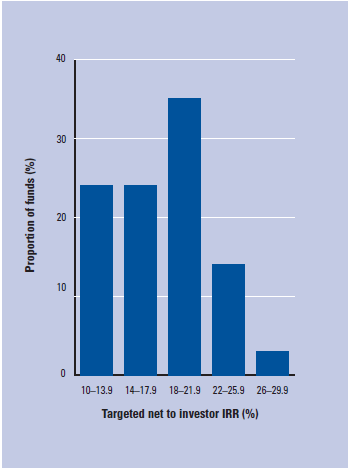

Figure 15: Distribution of internal rates of return (IRRs) targeted by fund or investment vehicle

Source: Preqin, 2009.

Note: The IRR is targeted by fund or investment vehicle.