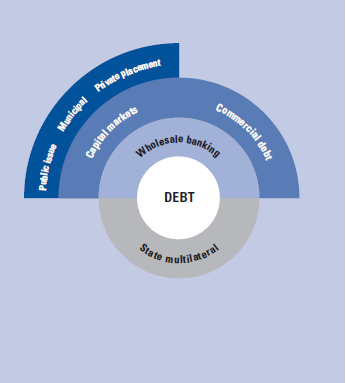

Wholesale banking provides two sources of debt funding: commercial bank debt and capital markets

There are primarily two sources of debt funding in the wholesale banking markets:

• commercial bank debt, and

• capital markets.

Over the past 10 years, around US$1.3 billion of funding for infrastructure has been provided through wholesale banking,1 with the majority-some 88 percent-coming through the commercial bank route. This is illustrated in Figure 1.

Figure 1: Sources of debt

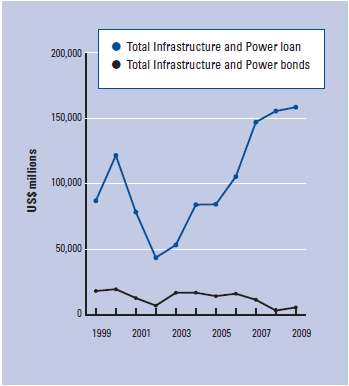

Since 2002, the relative prevalence of commercial loans vs. market-issued bonds has changed, with loans providing an increasing share of funding (Figure 2). The key characteristics of these two sources of debt are discussed in the following pages.

The financing structure for infrastructure will often change during the life of an asset as its risk profile changes. For example, commercial debt may be used to finance the construction of an asset, but once the asset is operational, the debt may be refinanced in the capital markets.

Figure 2: Infrastructure and Power global loans and bonds, 1999-2009

Source: Dealogic (accessed March 4, 2010).