The pricing of bonds is partially based on the characteristics of a predefined benchmark bond

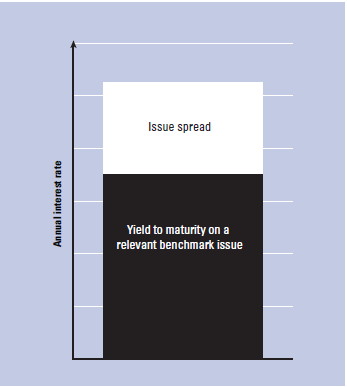

There are two main parts to pricing bonds at their issue:

• the yield to maturity on a benchmark bond, and

• the issue spread.

The yield to maturity is the promised yield (the internal rate of return, or IRR) on the bond if purchased at the current price and then held to its maturity. Because the price of a bond may fluctuate over time, this yield to maturity may fluctuate and so it represents a point-in-time market observation. The benchmark bond is the proxy for a risk-free investment with an equivalent yield to maturity. And, although you cannot say that any investment is absolutely risk-free, the convention is that government issuances, particularly in developed economies, are considered to be risk-free. For example, UK gilt-edged securities (gilts) and US Treasury bonds are generally considered to have zero risk because it is highly unlikely that either government would default on payment. Moreover, these bonds are easily traded (or highly liquid) in a transparent manner. Therefore they provide a common point to which all investors can relate.

However, given that governments issue many securities, the key question is how to decide which government security would be the best to consider as a benchmark for a particular upcoming bond issue.

Investors will want to identify a government issue that has a relationship between change in value and yield to maturity similar to the proposed project bond. The coefficient that captures this relationship is known as the modified duration; this can be calculated with reference to standard formulas and models.

The coupon or issue spread is a risk premium that an investor will require for accepting the risk specific to an individual issue. The components of the annual interest rate or coupon for a bond can be seen in Figure 3.

There may be an additional cost for a monoline guarantee; this product is covered later in this chapter.

Figure 3: Components of an annual interest rate for a bond

Source: PricewaterhouseCoopers 2006, internal training material.