Monoline insurers play an important role for infrastructure transactions by providing a guarantee for the bond holders

Guaranteed bonds are issued with a guarantee policy from a monoline insurer, which will have a very strong AAA credit rating. This guarantee is sometimes referred to as a wrap because the guarantee effectively wraps the underlying project credit rating to give it an AAA rating. The policy pays out to the investors if the issuer fails to make a scheduled coupon or principal payment. In this contract structure, therefore, the monoline insurer is the primary risk taker; the investors are exposed to the issuer only if, for some reason, the monoline insurer itself does not have the ability to pay out under the policy when called. For providing this guarantee, monolines will charge an upfront and annual fee.

Why bother issuing a bond with the benefit of such a policy? The reason is that many infrastructure projects would otherwise often have a rating of around a BBB and be exposed to the asssociated risks. Although this is still investment grade, it is not sufficient to attract many investors. Issuing a bond with a guarantee increases the institutional appetite for that issue because it expands the range of institutions able to invest; this in turn should bring down the pricing of the bond at issue. Monoline providers also undertake detailed due diligence on a transaction and participate in the negotiation of the transaction's contracts, a role that many bond investors believed was a benefit to the project and de-risked their investment, further increasing institutional appetite.

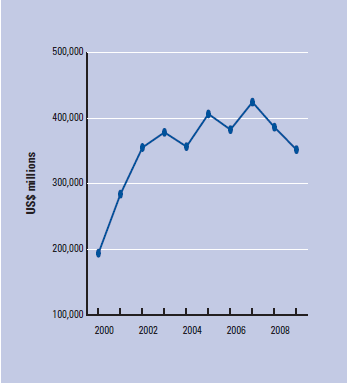

Figure 5: Value of municipal bond new issues, 2000-09

Source: Thomson Reuters, Global Public Finance database (accessed November 13, 2009).

Additionally, the fee paid to the monolines was less than the coupon that would likely be required by investors to buy the "unwrapped" low investment grade issue. The monoline guarantee is not only available for capital markets but is also used to guarantee some commercial debt.

Given the cost associated with the monoline guarantee, there is a need to analyze its cost benefit (which will come because investors will require a lower return or coupon) vs. that of an unwrapped issue.

One of the consequences of the current economic crisis and the monolines' involvement in guaranteeing mortgage-backed securities and collateralized debt obligations has been a significant change in the position of the monolines' ratings. As can be seen in Table 4, in late 2007 there were six AAA-rated monoline insurers, but by August 2009 there was only one: Assured Guaranty (which also now owns FSA). And even Assured Guaranty was on "negative watch," which means the rating agencies are leaning more toward assessing their position as deteriorating than as stable or improving.

Table 4: Credit ratings of monolines, November 2007 and August 2009

S&P financial strength rating | ||

Monoline | November 2007 | August 2009 |

Ambac Assurance Corp | AAA stable | CC |

Assured Guaranty Corp | AAA stable | AAA negative |

Financial Guaranty Insurance Co (FGIC) | AAA stable | Rating withdrawn in April 2009 |

Financial Security Assurance Inc (FSA) | AAA stable | AAA negative (acquired by Assured) |

MBIA Insurance Corp | AAA stable | BBB (internally structured) |

XL Capital Assurance Inc | AAA stable | A negative |

Source: Ratings from company websites: Ambac, available at http://www.ambac.com/; Assured Guaranty, available at http://www.assuredguaranty.com/; Financial Guaranty Insurance Co., available at http://www.fgic.com/; MBIA Inc., available at http://www.mbia.com/; XL Capital Assurance, available at http://www.xlcapital.com/xlc/xlc/xls.jsp (all accessed September 2009). World Economic Forum analysis.

This decline in the strength of the monoline ratings has had three main impacts:

• There has been a marked deterioration of the risk profile of existing projects. This has translated to significantly increased project coupons-investors coming into the transaction now would expect a higher return because they are putting little, if any, value to the monoline guarantee. This does not have an impact on the underlying project company but it does indicate where the market might be in terms of new projects.

• Some existing projects will have provisions in their financing documents that mean the project company has to pay an increased cost to a lender if the monoline's rating drops. This is most likely to occur where the monoline has guaranteed senior debt- for example, funds lent by the European Investment Bank.

• Overall loss of investor confidence in the value of the monolines' guarantee, even if they have retained their AAA rating, has meant that this funding structure is currently not a realistic option for bond issues. This has, in effect, closed much of the bond market to infrastructure-related issues other than those issues that can achieve ratings attractive to a sufficient part of the market in their own right.

• Currently the benchmark seems to be a rating of at least A.