Multilateral financing institutions play a vital role in the development of infrastructure

Across the globe there are a number of multilateral institutions (MLIs) that can generally be subdivided into to multilateral development banks (MDBs) and multilateral financial institutions (MFIs).1 Both of these groups of institutions play a vital role not only in the funding of infrastructure but also in providing transaction know-how and support to develop infrastructure programs and deliver projects. Although, because of terminology, these institutions are often grouped together, they each have their own specific treaty bases, visions, and priorities.

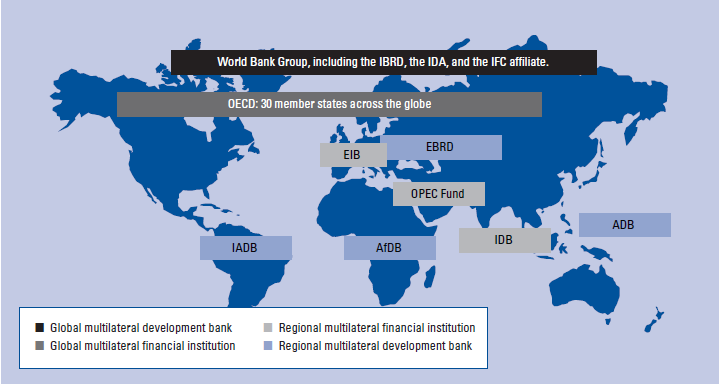

If you were to map the member states of these organizations, you would find significant overlap. For example, Spain is a member of all the MDBs-although it is classified as a non-borrowing member of the Inter-American Development Bank (IADB) and a non-regional member of the African Development Bank (AfDB). This multi-organizational membership can be replicated for the MFIs as well (see Figure 1). There are also a number of subregional organizations that are not detailed in the figure.

It is estimated that, in 2009, multilateral loans and guarantees to infrastructure projects in developing countries represented approximately US$20.4 billion;2 approximately US$6.5 billion in loans and guarantees went to projects in developed countries. This US$6.5 billion was dominated by direct lending by the European Investment Bank (EIB). This lending largely reflects the support that the EIB gave to many public-private partnership (PPP)-type transactions affected by the hiatus in the long-term commercial debt markets.

In both cases, the majority of facilities are direct project loans rather than guarantees. These figures include lending from both MDBs and export credit agencies (ECAs).3 The top 10 developing-country debtors are shown in Table 1. The total debt amount shown in the table includes private finance as well as multilateral debt.

MLIs typically have an AAA credit rating (see Appendix A.3) because the rating agencies' methodologies are largely based on the ratings of the state or sovereign donors. The agencies also adjust their ratings according to whether or not contributions have historically been made on a timely basis. They also consider how much of a buffer is available in the MLI's budget should a proportion of contributions be delayed.

An MLI's support for the funding of infrastructure often takes the form of facilitating private-sector investment, including direct investment in a private-sector provider, loans and/or guarantees alongside private finance, or helping to facilitate a market, such as through providing loan facilities in the local currency. Thus, MLIs are able to support both the capacity and afford-ability of private finance.

Figure 1: Geographic spread of multilateral institutions

Note: ADB = Asian Development Bank; AfDB = African Development Bank; EBRD = European Bank for Reconstruction and Development; EIB = European Investment Bank; IADB = Inter-American Development Bank; IBRD = International Bank of Reconstruction and Development; IDA = International Development Association; IDB = Islamic Development Bank; IFC = International Finance Corporation (World Bank Group affiliate); and OECD = Organisation for Economic Cooperation and Development.

The way MLIs assist with building the capacity of a market can be twofold:

• to lend alongside commercial banks where there is simply a shortage of commercial loans available for the project or enterprise-thus filling the gap; and

• to support the development of otherwise undeveloped markets for private finance.

The aim-to develop local financial markets-can be reached in many ways. Often the immediate goal can be to strengthen a state's institutions and organizational capability. Building this capacity might also include the development of individual infrastructure propositions or programs overall to the point where they are finance-able.

MLIs can assist with the affordability of projects because of their ability to provide long-term funding below the cost charged by commercial institutions. This is in part because the MLIs' cost of funding is lower than that of commercial banks (given their AAA ratings), but also because the objectives for their investment are not solely measured in terms of the return achieved. An example is the EIB's lending to PPP infrastructure projects where their risk margins for long-term debt when an asset is operational were, in October 2009, between 70 and 150 basis points, whereas commercial banks' margins were between 300 and 350 basis points. This difference can represent a significant long-term saving for a project over its whole life.