There are other enablers, such as export credit agencies

In addition to the direct sources of debt and equity, there are other important entities that we have referred to as enablers. These enablers can provide some form of financial assurance-whether in the form of a guarantee, an insurance policy, or other contractual support-in order to help a private investment to get off the ground. These enablers include export credit agencies.

Export credit agencies, known in trade finance as ECAs, are most often publicly-owned (government-owned) institutions that act as intermediaries between national governments and exporters to issue export financing. In particular, the ECAs provide assistance to the country's exporters to do business overseas. Most industrialized nations have at least one ECA, which is usually an official or quasi-official branch of the government. Generally, the ECAs focus on increasing exports, promoting domestic economic development, and helping small- and medium-sized enterprises (SMEs) that lack access to the capital markets.

Case in Point 1: The United Kingdom's Treasury Infrastructure Finance Unit |

In response to the difficulties in the financial markets, in March 2009 the UK government announced proposals to support the provision of private finance to public-private partnership-type projects. At the heart of this initiative was preparedness by government to supplement private-sector lending, where it is available on acceptable terms but insufficient amounts, to maintain the delivery of a pipeline of infrastructure projects. In some circumstances the government will provide 100 percent of the required finance. The government loans would be on terms similar to those of the commercial lenders and would rank equally to commercial lenders. This support is intended to be temporary and reversible, with the government loans to be sold to the private sector once the markets have recovered. There is some evidence that just the existence of this government support gave commercial lenders sufficient confidence that projects would reach financial close (when the financing documents are signed) and that this could be done without the actual government loans. |

ECA financing can take the form of credits (financial support) or credit insurance and guarantees or both, depending on the mandate the ECA has been given by its government. The ECAs can also offer credit or cover on their own account. This does not differ from normal banking activities. In a similar vein, the ECAs are unlikely to provide 100 percent of the loan amounts; they may also require a credit rating.

The ECAs frequently work together with multilateral institutions and commercial banks to provide credits, guarantees, and insurance and to encourage lending by taking on part of the risk inherent in a deal. Therefore, the use of export credits has tended to decrease whenever lenders have been willing to assume risk without them (for example, in the first part of the 1990s) and to increase when perceived risk has increased (for example, after the Asian crisis of 1997). The ECAs can also sign cooperation agreements with other ECAs in the common case when exports from more than one country are involved. In this situation, one ECA is usually designated as a "leader" who provides the total cover or finance, with the other ECAs involved reinsuring their shares of the risk.

Because of the complexities involved in bringing in another party to the project and also because of the relatively high premiums charged by the ECAs (in lieu of a loan margin) to reflect the relevant sovereign, corporate or project risk, ECA loan financing for an infrastructur project is usually attractive only when commercial lenders are unwilling to provide the requisite financing. In addition, the ECAs primarily support exports of equipment, while infrastructure contracts usually incur significant expenses under their construction agreemen and often involve local contractors where no export ele ment is involved. For transactions such as high-speed rail, the passenger cars or rolling stock may be candidates for ECA support. On the other hand, ECA financ ing is provided at low fixed rates and ECA involvement may provide a degree of intangible political support for the project. Some ECAs also provide loans or guarantee that are not linked to an export of equipment from the country concerned.

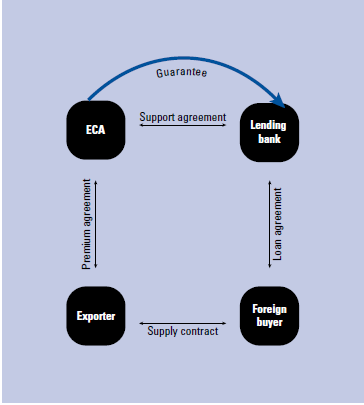

Figure 2: Simplified ECA transaction structure

Source: PricewaterhouseCoopers, 2009, internal note.

A simplified transaction structure showing how an ECA might fit into an infrastructure transaction is shown in Figure 2.

TAKE-AWAYS |

Multilateral and state support • Multilateral bank support is not just about providing • State support for private finance may come in a variety of |

Other enablers • Export credit agencies may be a source of support for some infrastructure-related transactions, particularly those involving the export of equipment such as trains. |