Medium-term economic prospects

1.20 The UK saw the biggest expansion in debt of all the world's major economies over the past decade.6 In the June Budget 2010, the Government acknowledged the likelihood that the financial crisis would have a lasting impact on the economy. The full scale and persistence of that impact is slowly becoming clearer.

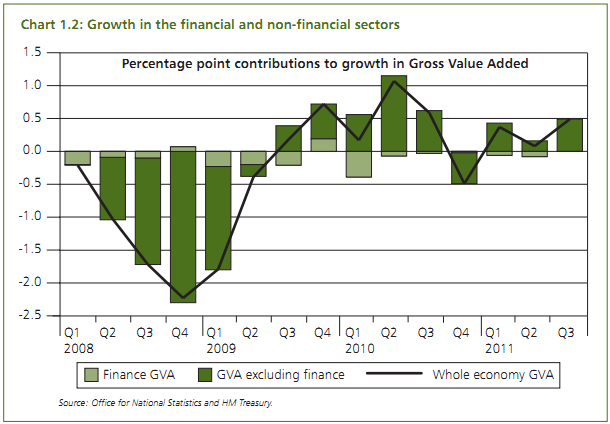

1.21 Unsustainable borrowing in the private and public sectors was accompanied by an increasing reliance on poorly regulated growth in the financial sector. As Chart 1.2 shows, since the end of the recession the financial sector has acted as a drag on growth. In the two and a quarter years since the recession ended, whole economy output has grown by 3.2 per cent, but output excluding the financial sector has grown more strongly, by 4.3 per cent.

1.22 After such a large credit boom, the process of balance sheet repair in the UK is likely to continue to weigh on demand. This is reflected in the OBR forecast. The household saving ratio is forecast to average around 6 per cent over the forecast horizon, up from around 3½ per cent at Budget 2011.

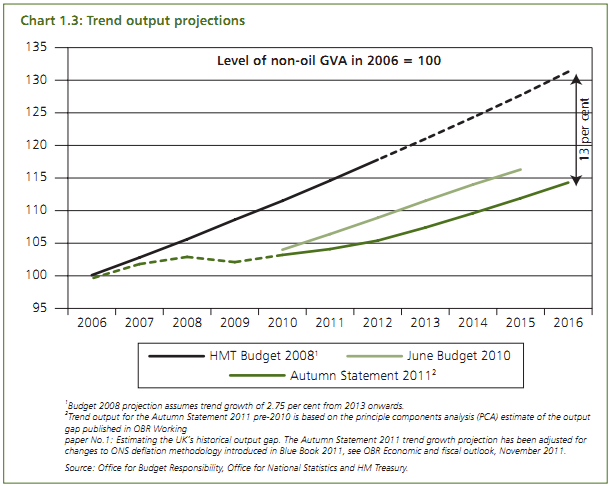

1.23 Compared with its previous forecasts, the OBR has substantially revised down its estimate of the level of potential output. While the OBR highlight the difficulties quantifying underlying productivity, they suggest the reduction is consistent with evidence that financial crises are typically associated with large output losses that persist for many years. The comprehensive analysis carried out by Reinhart and Rogoff concludes that "the aftermath of severe post-war financial crises shows that these crises have had a deep and lasting effect on asset prices, output and employment."7

1.24 The OBR now projects the trend rate of growth to average 1.1 per cent a year in 2011 and 2012, rising to 2.0 per cent in 2013 and 2.3 per cent thereafter. That compares with 2.35 per cent a year over that period projected at Budget 2011. Overall, these revisions reduce the level of trend output at the end of the forecast horizon by around 3½ per cent. The OBR has not revised up its judgement of the structural rate of unemployment, which remains at around 5¼ per cent.

1.25 There is also uncertainty over the degree of spare capacity in the economy - the extent to which actual output is below trend output. The Bank of England's November 2011 Inflation Report highlights the difficulties of assessing current levels of spare capacity. This is evidenced by the range of external organisations' estimates of the output gap in 2011.8 There is also uncertainty over the rate at which potential output will grow in the future.

1.26 Chart 1.3 compares the OBR's current and previous trend output projections with an extension of the Budget 2008 projection. It shows that by the end of the forecast, trend output is projected to be around 13 per cent below the level consistent with the pre-crisis projection. This difference suggests that the damage to potential output caused by the financial crisis has been greater than previously estimated.

_________________________________________________________________________________

6 The real effects of debt, Bank for International Settlements, working paper No. 352, September 2011.

7 This Time is Different: Eight Centuries of Financial Folly, Reinhart C. and Rogoff K., Princeton University Press, 2009.

8 External estimates of the output gap are discussed in Economic and fiscal outlook, OBR, November 2011.