Reducing risks

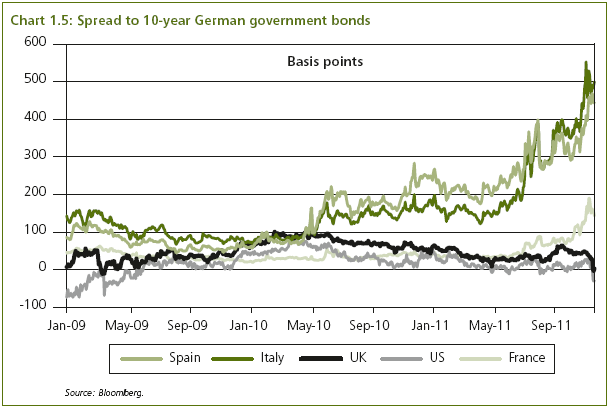

1.39 Clear and credible fiscal consolidation plans are essential to reduce the risk of a costly loss of market confidence in the UK. As Chart 1.5 shows, there is evidence that the Government's fiscal plans are contributing to improved market confidence, with UK long-term interest rates reaching a record low.

1.40 As the international debt crisis intensifies, global developments have shown that the consequences of losing market confidence can be sudden and severe:

• some European countries have smaller budget deficits than the UK, but have had to specify additional consolidation measures in recent months as a result of deteriorating economic conditions in the euro area; and

• in May 2010 the spread of UK gilts to German bunds was around the same level as that of Italy and Spain. However, Spain now faces long-term interest rates above six per cent and Italy above seven per cent.

1.41 A sharp rise in interest rates would be particularly damaging to an economy with the UK's level of indebtedness. As Table 1.3 shows, a one percentage point rise in government bond yields would add around £7.5 billion to debt interest payments by 2016-17. A one percentage point rise in effective mortgage rates would add £12 billion a year to households' mortgage interest payments.

Table 1.3: Impact of higher interest rates on debt interest payments

| £ billion | |||||

| Annual Increase In debt interest payments | |||||

| 2012-13 | 2013-14 | 2014-15 | 2015-16 | 2016-17 | Total |

Increase In Interest rates1 | ||||||

1 percentage point | 0.7 | 2.5 | 4.3 | 6.0 | 7.5 | 21.0 |

2 percentage point | 1.3 | 5.1 | 8.7 | 12.0 | 15.1 | 42.2 |

3 percentage points | 2.0 | 7.7 | 13.1 | 18.2 | 23.0 | 63.9 |

4 percentage points | 2.6 | 10.2 | 17.2 | 24.5 | 31.0 | 85.8 |

5 percentage points | 3.3 | 12.8 | 22.0 | 30.8 | 39.3 | 108.1 |

1 Above market gilt rates, consistent with the OBR's November 2011 Economic and fiscal outlook. Increases are applied to each gilt maturity from 2012 Q2 and are assumed to continue throughout the forecast period. Source: HM Treasury. | ||||||

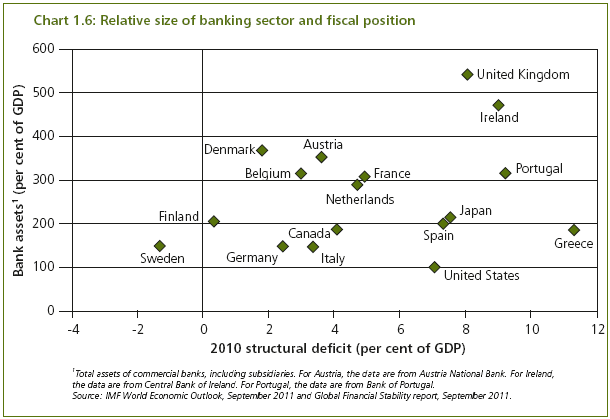

1.42 Fiscal consolidation also reduces the risk of negative feedback loops between weak public finances and a strained financial sector. These feedback loops can be very damaging, as evidenced by recent events in the euro area. The UK has a very large financial sector, both globally and relative to the size of its economy (see Chart 1.6), meaning any loss of investor confidence in the UK's fiscal position would not only affect the UK, but also the global economy. As the IMF have stated "the stability and efficiency of the UK financial system is a 'global public good' due to potential spillovers".11 It is the IMF's view that the UK's economic and financial sector policies have a systemic impact on the global economy.12, 13

1.43 Finally, recent research shows that higher levels of public debt would progressively weaken medium-term growth prospects.14 The Bank for International Settlements estimate that once general government gross debt exceeds 85 per cent of GDP, it starts to act as a drag on economic growth. The Government's fiscal plans ensure that debt is set on a downward trajectory from 2015-16.

_________________________________________________________________________________

11 Article IV staff report, IMF, July 2011.

12 Spillover Report, IMF, August 2011.

13 As set out in the IMF's April 2011 Fiscal Monitor, the IMF consider risks in a similar framework, publishing the Fiscal Sustainability Risk Map which shows the relative risk to fiscal sustainability from core fiscal variables, financial sector risk and macroeconomic uncertainty. Their analysis also considers the long-term fiscal challenge, the risk from the liability structure of public debt and policy implementation risks.

14 The real effects of debt, Bank for International Settlements, working paper No. 352, September 2011 and This Time is Different: Eight Centuries of Financial Folly, Reinhart C. and Rogoff K., Princeton University Press, 2009.