A.1 What is the Private Finance Initiative?

PFI is a long term contractual arrangement that makes the private sector responsible for, and bear the risks of, designing, building, financing, maintaining and sometimes operating a public sector asset (e.g. a school, hospital or road) to output specifications set by the public sector. The public sector commits to make a unitary payment to the private sector for use of the maintained asset, once it is operational, over the life of the contract (typically 20 to 30 years).

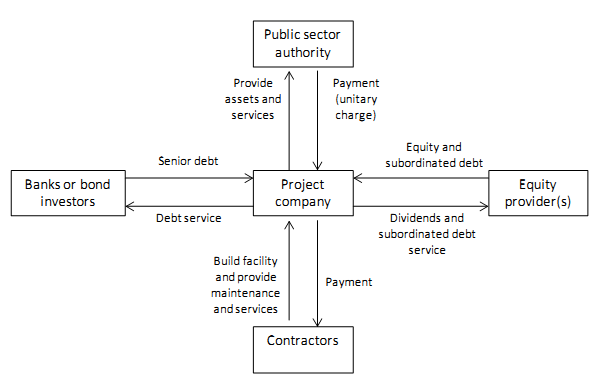

The private sector generally establishes a new special purpose project company to deliver the contract requirements. The project company raises private finance to cover the costs of the project, and sub-contracts with third parties for the delivery of construction and facilities management services required under the contract with the public sector.

PFI structures are usually highly geared, with 85 per cent to 93 per cent of the finance coming from debt and the remainder coming from equity.

The contract between the public sector procuring authority and the private sector project company formalises the transfer of risk. This will follow the Standardisation of PFI Contracts (SoPC) approach adopted in July 1999. The current version of the guidance is SoPC4, most recently updated in April 2009, can be accessed at

http://www.hm-treasury.gov.uk/ppp_standardised_contracts.htm