3.2 The risks and rewards tests required in order to make a balance sheet determination for the purposes of the National Accounts

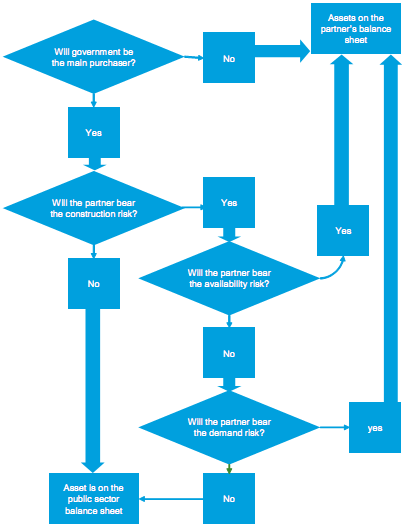

The MGDD states that the assets that underlie PFI and similar transactions can only be considered as being off the public sector balance sheet where there is strong evidence that the private sector is bearing most of the risk and reward attached to the asset in question. It was agreed that, for the purposes of simplicity, the determination should focus on the following three main categories of risk (termed the "MGDD primary risk factors" for the purposes of this paper):

- Construction risk;

- Demand risk; and

- Availability risk.

The following tests are then performed:

- If the public sector carries construction risk, the assets are viewed as being on the public sector balance sheet for the purposes of the National Accounts.

- Where the private sector holds construction risk, and one of either demand or availability risk, the assets are not considered to be on the public sector balance sheet for the purposes of National Accounts.

In certain cases, the MGDD guidance envisages that the decision on which party is bearing most of the risk attached to the asset in question may be borderline, having considered the MGDD primary risk factors. For example, this may be the case where certain risks (or elements of each risk category) are shared between the parties. The MGDD states that where, having considered the MGDD primary risk factors, the decision is borderline then other risks, and in particular residual value risk (discussed in more detail in section 3.2.6), should also be considered.

Figure 1 contains a flowchart extracted from the MGDD guidance.

Figure 1. Flowchart extracted from MGDD

Source: MGDD

When considering the National Accounts balance sheet determination it is important to understand what is meant by the term risk, what elements of a transaction are to be tested and what factors should be considered under the definition of construction, availability and demand risk.

It is also necessary to consider what, if any, impact the presence of any public sector finance in the project may mean for the allocation of risks associated with the asset and how to make a judgement in borderline cases.